Ex-Fossil Fuels Strategy defies Oil Price Rise

Osmosis launched the Resource Efficient Core (ex-fossil fuels) Fund with a $250 million seed in February 2021. The Fund was developed to offer investors a risk-controlled core portfolio which prohibits investment in companies that generate more than 5% of their revenues from fossil fuels or nuclear power generation, companies with any revenues from nuclear and controversial weapons and civilian firearms, tobacco companies, and companies in breach of any of the UN Global Compact Principles. The Strategy uniquely addresses both the supply side of fossil fuel energy generation through divestment and the demand side through the over and underweighting of companies based on their Resource Efficiency. The strategy is driven by the Osmosis Resource Efficiency factor, which is derived from an objectively driven research program that measures the world’s leading corporations’ environmental efficiency.

“The ability to weather asset price reflation in the energy sector as a result of rising oil prices was one of our primary goals in building the ex-fossil fuel strategy. Divestment decisions must be considered in the context of ‘fiduciary duty’ and should not be made at any cost nor undertaken without an awareness of active risk. Our models showed that the additional return derived from targeting Resource Efficient companies across the broader portfolio would help offset any such asset price inflation. Launching the Fund into an oil and commodity-based rally, we have been delighted to see the thesis hold true. “

Ben Dear, CEO

Since the Strategy’s inception, a UCITS Common Contractual Fund and a segregated account have been launched against the strategy. Total assets have reached USD 550m with East Sussex Pension Fund the latest high-profile client to adopt the strategy.

Over the one-year period the portfolio has successfully delivered on its four key objectives:

| Zero exposure to Fossil Fuel companies | |

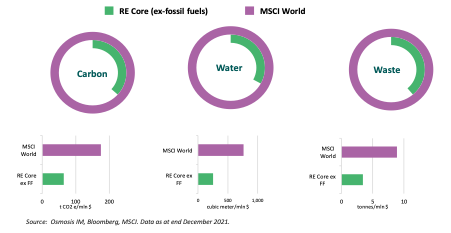

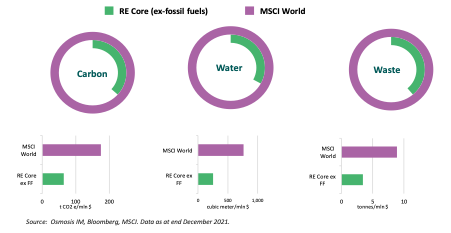

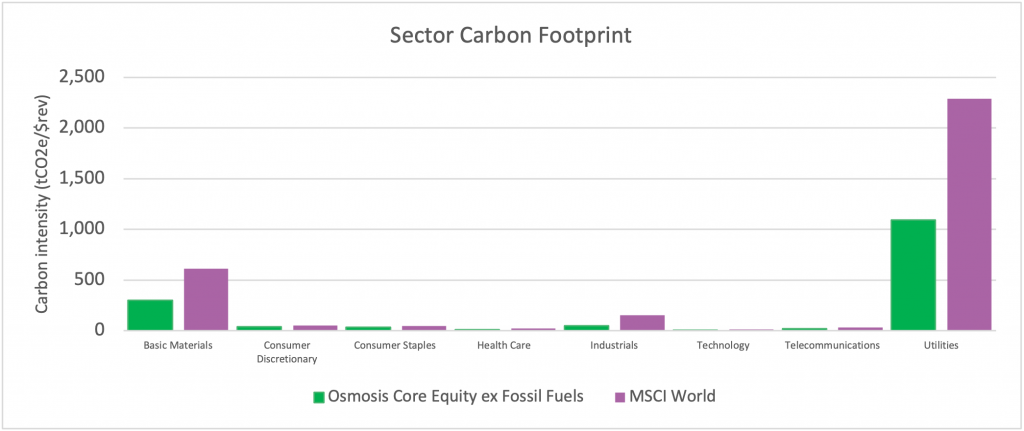

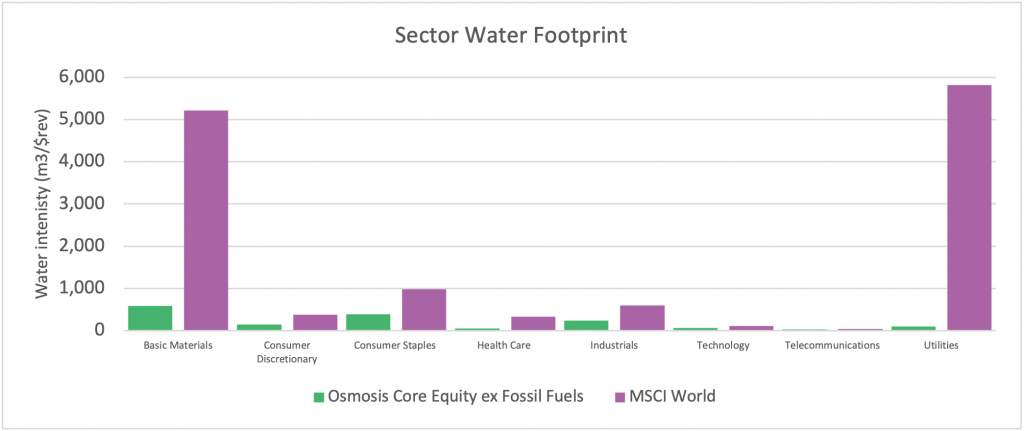

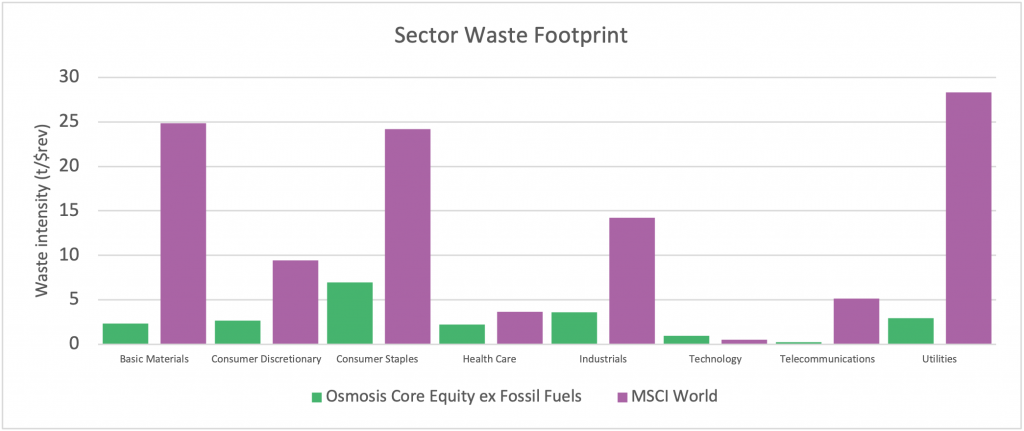

| Reduced carbon (-63%), water (-67%) and waste (-61%) footprint to MSCI World (28 Feb 22) | |

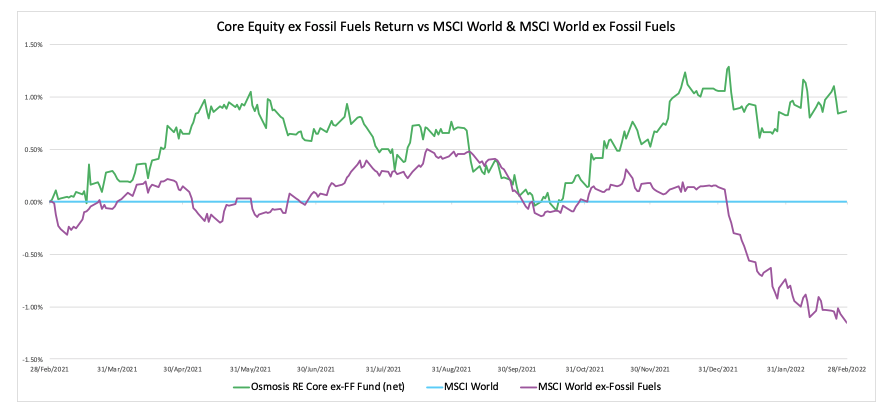

| Outperformed MSCI World (+0.90%) and MSCI World ex Fossil Fuels (+2.23%) net of fees | |

| Controlled risk to MSCI World such that active return is predominantly attributable to Resource Efficiency tilts and exclusion of Fossil Fuel companies. |

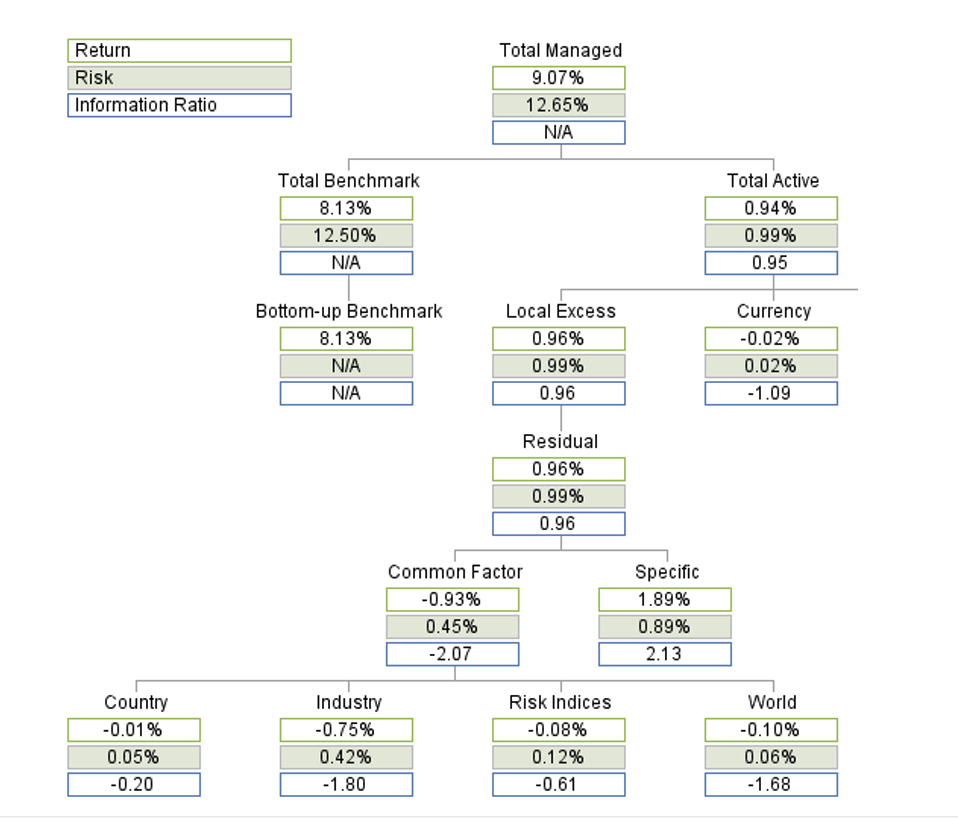

The active return is derived from two main sources of return.

- The negative industry effect (-0.75%) gross is almost entirely attributable to the exclusion of the Oil & Gas sector.

- The stock-specific return (+1.89%) gross which has more than offset the negative industry effect and has been the driver of outperformance within the strategy across EMEA, APAC, and N. America. The latter contributes the lion’s share.

The North American healthcare and IT sectors delivered strong performance while the communication services sector was the strongest driver of return within APAC and EMEA. The materials sector was one of the weaker performers with underperformance across all three regions of N. America, APAC, and EMEA.

The year-to-date outperformance of the energy sector has been particularly stark! The MSCI World ex Fossil Fuels index has significantly underperformed the MSCI World (-1.07%) whilst the Core Equity ex Fossil Fuels strategy underperformed by only -0.07%

The reconstituted ex fossil fuels portfolio has some unsurprising factor exposures relative to the cap-weighted benchmark. As of the end of February, excluding fossil fuel companies reduces the momentum and value exposure (across dividend yield, earnings yield and book-to-price) and increases the beta factor exposure relative to the MSCI World.

Conversely, the re-optimised Osmosis Core Equity (ex-fossil-fuels) strategy neutralises both the beta and momentum exposures to the underlying benchmark as well as tightening the value exposure. The result is only a marginally negative dividend yield exposure, a neutral book-to-price, and a marginally positive earnings yield exposure.

The reconstituted ex-fossil fuels portfolio overweights IT and Healthcare whilst remaining heavily underweight energy and utility exposures. On the other hand, the Core Equity (ex-fossil fuels) portfolio underweights the energy sector but has less exposure to both the IT and Healthcare sector. Importantly, companies in the utilities sector that have demonstrated that they have started a meaningful transition path to cleaner energy sources can be reincluded. A smart screen identifies companies with revenues from oil & gas greater than 5% of total revenues, but with greater than 50% energy generation from renewable sources (such as hydroelectric and solar/wind) can be included in the portfolio, rewarding positive change. This includes the likes of Orsted, EDP, and Consolidated Edison.

As can be seen in the table below, the risk neutralisation of the Osmosis strategy has led to a vastly improved return profile. This is not alpha targeting, but purely naturalisation of unintended risk factors.

| Active Return Attribution to MSCI World | MSCI World reconstituted ex fossil fuels portfolio (gross) | Osmosis Core ex fossil fuels (gross) |

| Country | -0.05% | -0.01% |

| Industry | -0.71% | -0.43% |

| O&G Contribution | -0.48% | -0.48% |

| Non O&G Contribution | -0.23% | 0.05% |

| Style Factors | -0.28% | -0.08% |

| Idiosyncratic / stock specific | -0.36% | 0.46% |

| TOTAL | -1.41% | -0.07% |

From a style factor perspective, the MSCI World reconstituted ex fossil fuels portfolio has been penalised on both its value (earnings yield, book-to-price, dividend yield) and beta exposures while the Osmosis Core Equity (ex-fossil fuels) Strategy has dampened such effects. As can be seen, the style factor exposure was -0.28% for a simple exclusion portfolio whilst the Osmosis solution reduced this to -0.08%.

Both portfolios have been penalised for their negative weighting to the oil and gas sector which delivered -0.48% of returns within both strategies. The Osmosis core program reweights to sectors based on minimising the active risks back to the MSCI World benchmark. This has led to a more neutral weighting compared to the more simplistic approach which reweights on market cap, increasing the exposure to the largest sectors within the benchmark. Within the Osmosis program, the industry exposures delivered a negligible 0.05% of active return whilst the market cap variant had a -0.23% negative contribution from its industry exposures.

The stock-specific, idiosyncratic improvement within the Osmosis core ex fossil fuel strategy is explained by the tilts to the Resource Efficiency signal. Whilst the largest detractor to idiosyncratic returns in both the Core ex Fossil Fuels and the reconstituted ex fossil fuels portfolio included both Berkshire Hathway and Exxon Mobil, the core program also included the underweight exposure to Accenture, whilst the re-constituted portfolio included the exclusion of Chevron.

Focusing on the top contributors to the idiosyncratic return in each of the respective strategies, the top 10 contributors in the reconstituted ex fossil fuels portfolio contributed 0.13% with Apple and Amazon amongst the top overweight contributors whilst the exclusion of Nextera Energy was rewarded. Conversely, the top 10 contributors in the Core (ex-fossil fuel Strategy) contributed 0.57% with the top contributors including Apple, Nintendo, and Nucor Corp.

Sustainable Outcomes

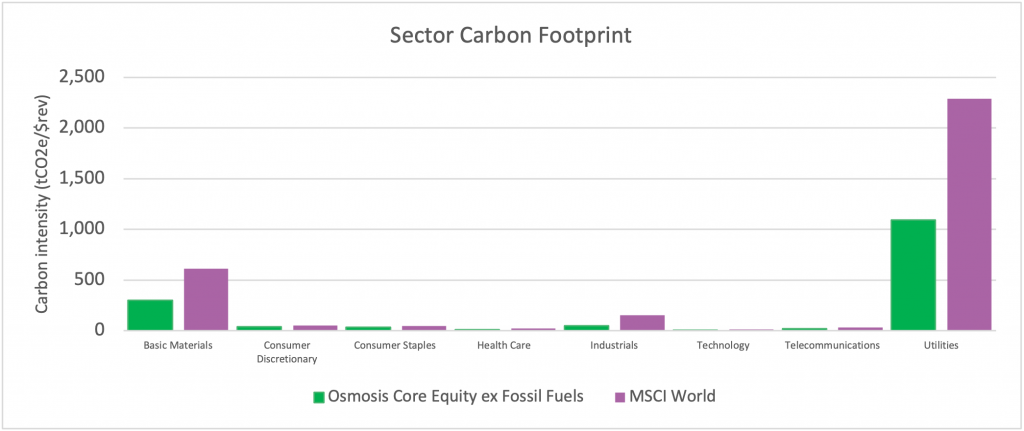

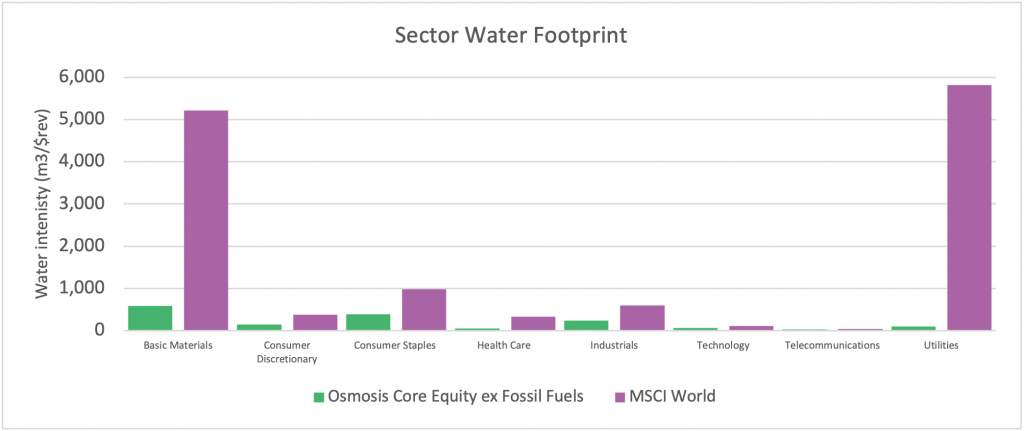

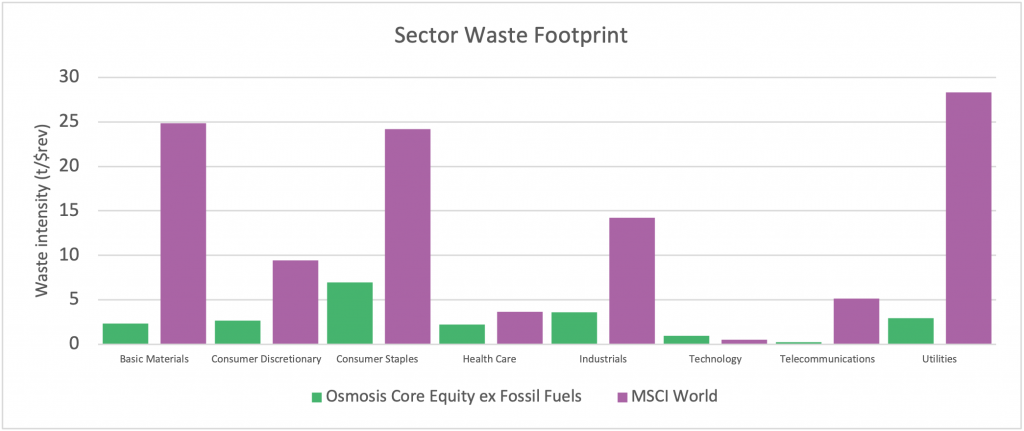

The Osmosis Resource Efficient Core equity (ex-fossil fuels) strategy has a significantly reduced carbon (-63%), water (-67%), and waste (-61%) footprint relative to the underlying MSCI World benchmark. As Resource Efficiency is targeted across the remaining sectors of the economy, we can show the footprint savings across carbon, water, and waste across the whole economy as can be seen by sector environmental footprints below.

Source: Osmosis IM, Bloomberg, Barra, LLC’s analytics and data were used in the preparation of this report. Copyright 2015 BARRA, LLC. All Rights Reserved

Source: Osmosis IM, Bloomberg, Barra, LLC’s analytics and data were used in the preparation of this report. Copyright 2015 BARRA, LLC. All Rights Reserved

Strategy Outlook

Inflationary pressures no longer appear as transitory as first warned. Prices of goods are being further exacerbated by the Ukraine crisis as energy and commodity prices soar. We predict significant rate hikes from the Federal Reserve will follow, putting further pressure on those companies with weaker balance sheets and encouraging a refocus on current company fundamentals relative to speculative growth companies.

Inevitably, there will be continued pressure on the strategy from the exclusion of fossil fuels, however, we believe this will be constrained to the price of oil, and we expect the neutralisation of the value exposure back to the benchmark to alleviate some other traditional factor risks which may arise from an inflationary period.

In tandem, we believe high commodity prices will penalise those companies with more resource-intensive business models. Compounding high commodity prices is the rising price of carbon. The European ETS scheme is currently trading at EUR70 having peaked at just under EUR100 before the current Ukraine crisis.

Despite significant pressures on both households and corporates, governments have been resisting pressure to reduce “green taxes”. Conversely, the European Union is continuing with the EU Taxonomy, whereby corporate activities within intensive sectors are analyzed on their environmental sustainability. These are adding significant inflationary pressures onto balance sheets. Whilst such pressures continue, the political landscape within the energy sectors remains cloudy. The U-turn on fracking and revitalisation of coal power plants are naturally at odds with long-term climate goals.

The Resource Efficient Core Equity ex-fossil fuels Strategy targets the most Resource Efficient companies as determined by the Osmosis Model of Resource Efficiency. With rising inflation driven higher by commodity prices, tightening of both fiscal and monetary policy, the drive to transition companies to become more efficient will we believe only accelerate, providing a tailwind for our thesis in the short to medium term.

Osmosis Resource Efficiency Core Equity CCF terms:

| Fund Name | Osmosis Resource Efficient Core Equity (ex-fossil fuels) Fund |

| Strategy | Long-only Sustainable Core Equity Enhancement Strategy |

| Central Bank of Ireland approval | 21 December 2020 |

| Fund Structure | Osmosis Resource Efficient Core Equity (ex-fossil fuels) Fund is a sub-fund of Osmosis UCITS CCF, an open-ended umbrella common contractual fund with segregated liability between sub-funds authorised and regulated by the Central Bank of Ireland as a UCITS pursuant to the UCITS Regulations. |

| CCF | A common contractual fund (CCF) may provide tax transparency depending on the type and jurisdiction of an investor |

| Benchmark | MSCI World (Developed) USD NTR |

| Target Return | Benchmark + 0.7% |

| Administrator | Northern Trust International Fund Administration Services (Ireland) Limited |

| Auditor | EY |

| Legal Counsel | Pinsent Masons (Ireland) |

| Minimum Investment ($ USD) | $25,000,000 |

| Liquidity | Daily |

| Investment Management Fee | Class A – 0.10% pa (minimum $250m) Class B – 0.25% pa (minimum $10m) Class C – 0.30% pa (minimum $500k) Class D (hedged) – 0.25% pa (minimum $10m) |

| Base Currency | USD |

| Investor Type | Individuals not eligible |

IMPORTANT INFORMATION:

Global Investors (ex US). This report is issued in the UK by Osmosis Investment Management UK Limited (“Osmosis”). Osmosis is authorised and regulated by the Financial Conduct Authority “FCA” with FRN 765056. This document is a “financial promotion” within the scope of the rules of the FCA. In the United Kingdom, the issue or distribution of this document is being made only to and directed only at professional clients (as defined in the rules of the FCA) (“Professional Clients”). This document must not be acted or relied upon by persons who are not Professional Clients. Any investment or investment activity to which this document relates is available only to Professional Clients and will be engaged in only with Professional Clients.

US Investors. This document is issued by Osmosis Investment Management US LLC (“Osmosis”). Osmosis Investment Management UK Limited (“Osmosis UK”) is an affiliate of Osmosis and has been operating the Osmosis Model of Resource Efficiency. Osmosis UK is regulated by the FCA. Osmosis and Osmosis UK are both wholly owned by Osmosis (Holdings) Limited (“OHL”). Osmosis Investment Management AUM includes discretionary assets under management of OIM US and OIM UK and assets invested in model programs provided by OIM US and OIM UK.

The Core Equity – Ex Fossil Fuel Fund is not available for US Investors. Separate accounts are available for U.S. investors using the same model and investment objective of the Fund.

Investments like these are not suitable for most investors as they are speculative and involve a high degree risk, including risk of loss of capital. There is no assurance that any implied or stated objectives will be met. This material is provided for illustrative purposes only and is for use in one-on-one presentations only.

This document alone does not constitute: a recommendation by, or advice from, Osmosis or any other person to a recipient of this document on the merits or otherwise of participating in the products, investments and transactions referred to in this document; a guarantee, forecast, projection or estimate of any future returns (or cash flows) on any investment; or investment, tax or other advice. Potential investors should read the relevant fund’s prospectus, or offering memorandum, and consult their own legal, tax, accounting and other professional advisers before making any investment. Prospectuses and EEA key investor information documents for the Osmosis Resource Efficient Core Equity Fund are available in English and may be obtained here or by contacting Osmosis’s registered office.

A decision may be taken at any time to terminate the arrangements made for the marketing of the Fund in any EEA Member State in which it is currently marketed. In such circumstances, Shareholders in the affected EEA Member State will be notified of this decision and will be provided with the opportunity to redeem their shareholding in the Fund free of any charges or deductions for at least 30 working days from the date of such notification. As required under sub-paragraph 2 of Article 4(3) of the CBDR.

Performance.

NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN. An investor’s actual account is managed by Osmosis based on the strategy, but the actual composition and performance of the account may differ from those of the strategy due to differences in the timing and prices of trades, and the identity and weightings of securities holdings.

Gross Performance. Gross Returns are gross of fees and in USD unless indicated otherwise. Gross return results do not reflect the deduction of investment advisory fees. Gross performance results may include the reinvestment of dividends and other account earnings. A client’s return will be reduced by the advisory fees and other expenses it may incur as a client. For example, the deduction of a 1% advisory fee over a 10-year period would reduce a 10% gross return to an 8.9% net return. Please see the specific performance disclosure under each slide for additional details. Our fees are fully disclosed in our Part 2A of Form ADV and may be updated from time to time.

Net Performance. Net returns are net of fees and in USD unless indicated otherwise. Net returns are net of fees, costs and dividend withholding tax. Different fees may apply to a client’s account and a client’s returns may be further reduced by the advisory fee and other expenses incurred in the management of its account. Please see the specific performance disclosure under each slide for additional details. Our fees are fully disclosed in our Part 2A of Form ADV and may be updated from time to time.

Past performance may not be indicative of future results. Different types of investments and/or investment strategies involve varying levels of risk, and there can be no assurance that any specific investment or investment strategy will be profitable. Changes in exchange rates may have an adverse effect on the value price or income of the product. No current or prospective client should assume that future performance will be profitable, equal the performance results reflected, or equal any corresponding historical benchmark index. For reasons including variances in fees, differing client investment objectives and/or risk tolerance, market fluctuation, the date on which a client engaged Osmosis’s services, and any account contributions or withdrawals, the performance of a specific client’s account may have varied substantially from the referenced performance results. In the event that there has been a change in a client’s investment objectives or financial situation, the client is encouraged to advise us immediately. It is important to remember that the value of investments, and the income from them, can go down as well as up and is not guaranteed and that you, the investor, may not get back the amount originally invested. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Osmosis accepts no liability for any failure to meet such forecast, projection or target. Past performance is not an indication of future performance.

Investment Examples. The investment examples set forth in this presentation should not be considered a recommendation to buy or sell any specific securities. There can be no assurance that such investments will remain in the strategy or have ever been held in the strategy. The case studies have been selected to be included in this presentation based upon an objective non-performance basis because we believe these are indicative of our strategy and investment process. Nothing herein shall be deemed to limit the investment strategies or investment opportunities to be pursued by Osmosis.

Information pertaining to Osmosis’s advisory operations, services, and fees are set forth in Osmosis’s current disclosure statement (Form ADV Part 2A), a copy of which is available from Osmosis upon request and from the SEC at http://www.adviserinfo.sec.gov./Information regarding OHL is available from us upon request.

Benchmarks. The historical index performance results for all benchmark indexes do not reflect the deduction of transaction, custodial, or management fees, the incurrence of which would have the effect of decreasing indicated historical performance results. Indexes are unmanaged and are not available for direct investment. The historical performance results for all indices are provided exclusively for comparison purposes only and may or may not be an appropriate measure to provide general comparative information to assist an individual client or prospective client in determining whether Osmosis performance meets, or continues to meet, his/her investment objective(s). The referenced benchmarks may or may not be appropriate benchmarks against which an observer should compare our returns.

The MSCI World Index captures large and midcap representation across 23 Developed Markets countries. With 1,645 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI World ex Fossil Fuels Index is based on the MSCI World Index, its parent index, and includes large and mid-cap stocks across 23 Developed Markets (DM) countries*. The index represents the performance of the broad market while excluding companies that own oil, gas, and coal reserves.

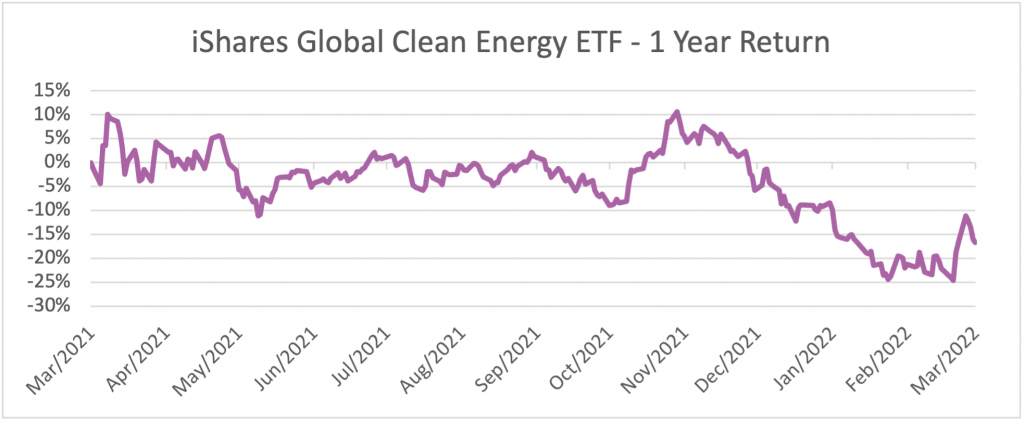

The iShares Global Clean Energy ETF (ICLN) seeks to track the investment results of an index composed of global equities in the clean energy sector.

A Challenging Backdrop

Source: Osmosis IM, Bloomberg, Barra, LLC’s analytics and data were used in the preparation of this report. Copyright 2015 BARRA, LLC. All Rights Reserved

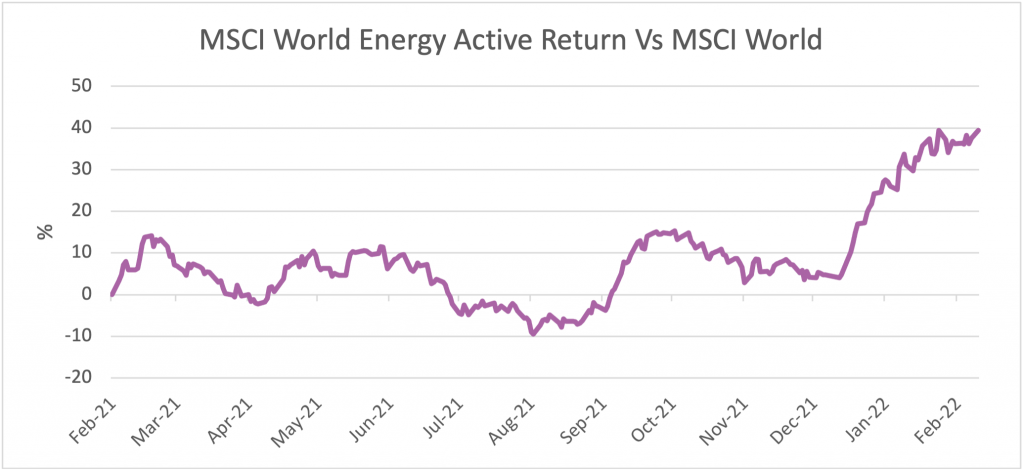

While a year is a short period in a Fund’s life you could argue that there has been no other period in recent history with which to better test the efficacy of this strategy. Since the inception of the Fund, we have seen oil rise from $62 to circa $120 per barrel. The MSCI World Energy sector has been the strongest performing GICS Sector, delivering 47% (19/2/21 – 28/2/22), outperforming the MSCI World by 39.5%. Sustainability strategies have struggled as the traditional offsets (such as green revenues or renewable companies) have also underperformed the general market. For example, the iShares Global Clean Energy ETF has underperformed the MSCI World (NDDUWI Index) by 29.21% to month-end since the inception of the Osmosis Core Equity ex Fossil Fuel Fund.

Source: Osmosis IM, Bloomberg, Barra, LLC’s analytics and data were used in the preparation of this report. Copyright 2015 BARRA, LLC. All Rights Reserved

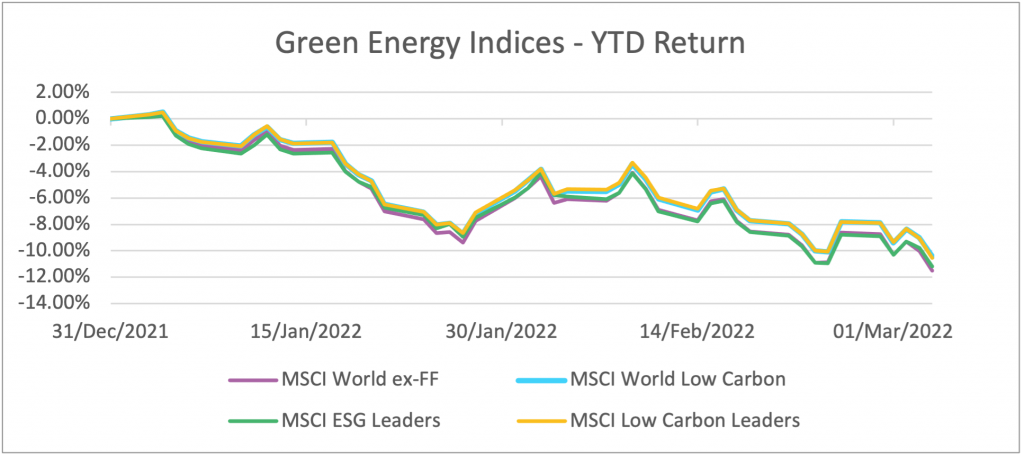

Source: Osmosis IM, Bloomberg, MSCI, Barra, LLC’s analytics and data were used in the preparation of this report. Copyright 2015 BARRA, LLC. All Rights Reserved

Despite this, the Osmosis Resource Efficient Core (ex-fossil-fuels) Fund delivered a positive return of 8.54% since its inception (18/02/21), outperforming the MSCI World by 0.90% net and the MSCI World (ex-Fossil Fuels) index by 2.23% net.

Source: Osmosis IM, Bloomberg, Barra LLC’s analytics and data were used in the preparation of this report. Copyright 2015 BARRA, LLC. All Rights Reserved. MSCI World is NDDUWI Index, Gross Total Return (USD). MSCI World ex fossil fuels is MX3WOFFNU Index, Gross Total Return (USD). MSCI World is NDDUWI Index, Gross Total Return (USD). Osmosis RE Core Equity ex fossil fuels is a systematic investment strategy created for the purpose of illustrating the effect of excluding fossil fuels and other ethical screens on the Osmosis Core Equity portfolio (Osmosis screens). Returns represent the actual returns for the Core equity (ex-fossil fuels) Fund, Class A. Such returns are net of fees, costs and dividend withholding tax. Different fees apply to each share class and a client’s returns will be reduced by the advisory fee and other expenses incurred in the management of its account. Please see the attached performance calculation disclosure language. Past performance is not an indication of future performance.

Past performance is not indicative of future results. See Disclaimer Page for important information on calculations of the above data.

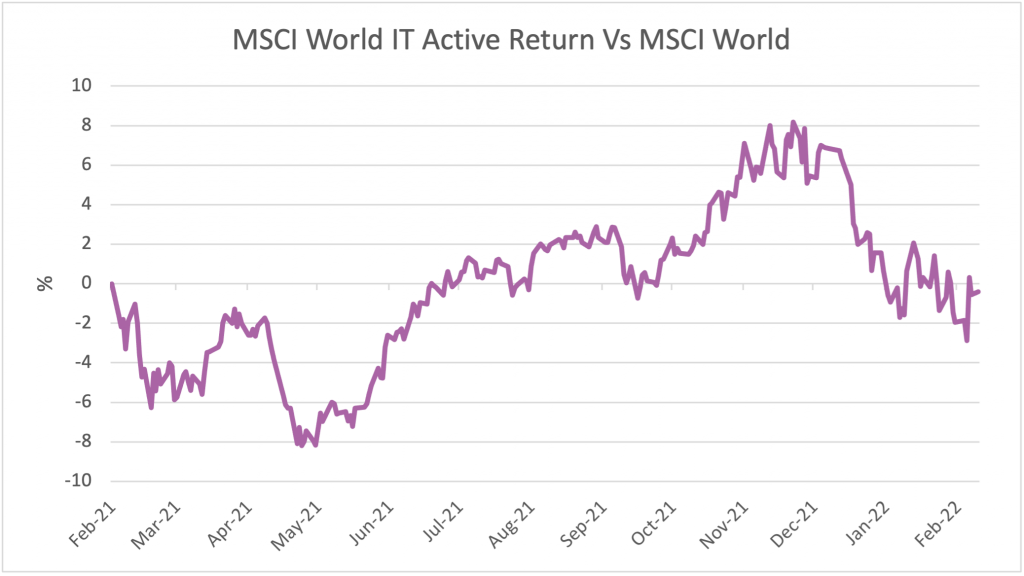

A Sophisticated Optimisation Process

The Fund’s success can be attributed to a move away from the traditional market cap-weighted approach which would naturally increase the active weight in the largest sectors and countries. Instead, the risk brought into the portfolio through divestment is reallocated to the most highly correlated companies that remain to match the missing exposures and pushing the risk towards the most resource-efficient companies in the universe. This sophisticated optimisation process maintains tight country, industry, and sector exposures to the benchmark avoiding the unintended bet of simply overweighting the technology sector or other ‘ESG’ favourites.

The chart below shows the active return of the IT sector versus the MSCI World over the period under review.

Source: Osmosis IM, Bloomberg, MSCI, Barra, LLC’s analytics and data were used in the preparation of this report. Copyright 2015 BARRA, LLC. All Rights Reserved

“By targeting those companies with the most compatible style factors, whilst keeping the country and sector exposures as tight to the Index as possible, we have created a portfolio that closely replicates the characteristics of the Index, while delivering on the objectives of the Osmosis Resource Efficient Model.”

Alex Stephen – Portfolio Manager

The strategy targets the maximum Resource Efficiency exposure whilst replicating the traditional factor exposures of the MSCI World benchmark such that the ex-ante active risk is explained by both the Resource Efficiency factor tilts as well as the divestment from the Fossil Fuel industry.

MSCI World is GDDUWI Index, Gross Total Return (USD). Osmosis RE Core Equity ex Fossil Fuels is a systematic investment strategy created for the purpose of illustrating the effect of excluding fossil fuels and other ethical screens on the Osmosis Core Equity portfolio (Osmosis screens). Returns represent the actual returns for the Core equity (ex-Fossil Fuels) Fund, Class A. Returns are net of dividend withholding taxes. All returns are gross of fees and a client’s returns will be reduced by the advisory fee and other expenses incurred in the management of its account. Performance attribution is calculated on an individual security basis and therefore is gross of fees and expenses. Past performance is not an indication of future performance.

NB: To estimate the returns of the MSCI World ex Fossil Fuels, we recreated the index year-to-date using the core equity ex fossil fuels strategy’s screening criteria. The remaining companies were then weighted using their free-float market cap as per the methodology for the MSCI World.

The active return is derived from two main sources of return.

- The negative industry effect (-0.75%) gross is almost entirely attributable to the exclusion of the Oil & Gas sector.

- The stock-specific return (+1.89%) gross which has more than offset the negative industry effect and has been the driver of outperformance within the strategy across EMEA, APAC, and N. America. The latter contributes the lion’s share.

The North American healthcare and IT sectors delivered strong performance while the communication services sector was the strongest driver of return within APAC and EMEA. The materials sector was one of the weaker performers with underperformance across all three regions of N. America, APAC, and EMEA.

The year-to-date outperformance of the energy sector has been particularly stark! The MSCI World ex Fossil Fuels index has significantly underperformed the MSCI World (-1.07%) whilst the Core Equity ex Fossil Fuels strategy underperformed by only -0.07%

The reconstituted ex fossil fuels portfolio has some unsurprising factor exposures relative to the cap-weighted benchmark. As of the end of February, excluding fossil fuel companies reduces the momentum and value exposure (across dividend yield, earnings yield and book-to-price) and increases the beta factor exposure relative to the MSCI World.

Conversely, the re-optimised Osmosis Core Equity (ex-fossil-fuels) strategy neutralises both the beta and momentum exposures to the underlying benchmark as well as tightening the value exposure. The result is only a marginally negative dividend yield exposure, a neutral book-to-price, and a marginally positive earnings yield exposure.

The reconstituted ex-fossil fuels portfolio overweights IT and Healthcare whilst remaining heavily underweight energy and utility exposures. On the other hand, the Core Equity (ex-fossil fuels) portfolio underweights the energy sector but has less exposure to both the IT and Healthcare sector. Importantly, companies in the utilities sector that have demonstrated that they have started a meaningful transition path to cleaner energy sources can be reincluded. A smart screen identifies companies with revenues from oil & gas greater than 5% of total revenues, but with greater than 50% energy generation from renewable sources (such as hydroelectric and solar/wind) can be included in the portfolio, rewarding positive change. This includes the likes of Orsted, EDP, and Consolidated Edison.

As can be seen in the table below, the risk neutralisation of the Osmosis strategy has led to a vastly improved return profile. This is not alpha targeting, but purely naturalisation of unintended risk factors.

| Active Return Attribution to MSCI World | MSCI World reconstituted ex fossil fuels portfolio (gross) | Osmosis Core ex fossil fuels (gross) |

| Country | -0.05% | -0.01% |

| Industry | -0.71% | -0.43% |

| O&G Contribution | -0.48% | -0.48% |

| Non O&G Contribution | -0.23% | 0.05% |

| Style Factors | -0.28% | -0.08% |

| Idiosyncratic / stock specific | -0.36% | 0.46% |

| TOTAL | -1.41% | -0.07% |

From a style factor perspective, the MSCI World reconstituted ex fossil fuels portfolio has been penalised on both its value (earnings yield, book-to-price, dividend yield) and beta exposures while the Osmosis Core Equity (ex-fossil fuels) Strategy has dampened such effects. As can be seen, the style factor exposure was -0.28% for a simple exclusion portfolio whilst the Osmosis solution reduced this to -0.08%.

Both portfolios have been penalised for their negative weighting to the oil and gas sector which delivered -0.48% of returns within both strategies. The Osmosis core program reweights to sectors based on minimising the active risks back to the MSCI World benchmark. This has led to a more neutral weighting compared to the more simplistic approach which reweights on market cap, increasing the exposure to the largest sectors within the benchmark. Within the Osmosis program, the industry exposures delivered a negligible 0.05% of active return whilst the market cap variant had a -0.23% negative contribution from its industry exposures.

The stock-specific, idiosyncratic improvement within the Osmosis core ex fossil fuel strategy is explained by the tilts to the Resource Efficiency signal. Whilst the largest detractor to idiosyncratic returns in both the Core ex Fossil Fuels and the reconstituted ex fossil fuels portfolio included both Berkshire Hathway and Exxon Mobil, the core program also included the underweight exposure to Accenture, whilst the re-constituted portfolio included the exclusion of Chevron.

Focusing on the top contributors to the idiosyncratic return in each of the respective strategies, the top 10 contributors in the reconstituted ex fossil fuels portfolio contributed 0.13% with Apple and Amazon amongst the top overweight contributors whilst the exclusion of Nextera Energy was rewarded. Conversely, the top 10 contributors in the Core (ex-fossil fuel Strategy) contributed 0.57% with the top contributors including Apple, Nintendo, and Nucor Corp.

Sustainable Outcomes

The Osmosis Resource Efficient Core equity (ex-fossil fuels) strategy has a significantly reduced carbon (-63%), water (-67%), and waste (-61%) footprint relative to the underlying MSCI World benchmark. As Resource Efficiency is targeted across the remaining sectors of the economy, we can show the footprint savings across carbon, water, and waste across the whole economy as can be seen by sector environmental footprints below.

Source: Osmosis IM, Bloomberg, Barra, LLC’s analytics and data were used in the preparation of this report. Copyright 2015 BARRA, LLC. All Rights Reserved

Source: Osmosis IM, Bloomberg, Barra, LLC’s analytics and data were used in the preparation of this report. Copyright 2015 BARRA, LLC. All Rights Reserved

Strategy Outlook

Inflationary pressures no longer appear as transitory as first warned. Prices of goods are being further exacerbated by the Ukraine crisis as energy and commodity prices soar. We predict significant rate hikes from the Federal Reserve will follow, putting further pressure on those companies with weaker balance sheets and encouraging a refocus on current company fundamentals relative to speculative growth companies.

Inevitably, there will be continued pressure on the strategy from the exclusion of fossil fuels, however, we believe this will be constrained to the price of oil, and we expect the neutralisation of the value exposure back to the benchmark to alleviate some other traditional factor risks which may arise from an inflationary period.

In tandem, we believe high commodity prices will penalise those companies with more resource-intensive business models. Compounding high commodity prices is the rising price of carbon. The European ETS scheme is currently trading at EUR70 having peaked at just under EUR100 before the current Ukraine crisis.

Despite significant pressures on both households and corporates, governments have been resisting pressure to reduce “green taxes”. Conversely, the European Union is continuing with the EU Taxonomy, whereby corporate activities within intensive sectors are analyzed on their environmental sustainability. These are adding significant inflationary pressures onto balance sheets. Whilst such pressures continue, the political landscape within the energy sectors remains cloudy. The U-turn on fracking and revitalisation of coal power plants are naturally at odds with long-term climate goals.

The Resource Efficient Core Equity ex-fossil fuels Strategy targets the most Resource Efficient companies as determined by the Osmosis Model of Resource Efficiency. With rising inflation driven higher by commodity prices, tightening of both fiscal and monetary policy, the drive to transition companies to become more efficient will we believe only accelerate, providing a tailwind for our thesis in the short to medium term.

Osmosis Resource Efficiency Core Equity CCF terms:

| Fund Name | Osmosis Resource Efficient Core Equity (ex-fossil fuels) Fund |

| Strategy | Long-only Sustainable Core Equity Enhancement Strategy |

| Central Bank of Ireland approval | 21 December 2020 |

| Fund Structure | Osmosis Resource Efficient Core Equity (ex-fossil fuels) Fund is a sub-fund of Osmosis UCITS CCF, an open-ended umbrella common contractual fund with segregated liability between sub-funds authorised and regulated by the Central Bank of Ireland as a UCITS pursuant to the UCITS Regulations. |

| CCF | A common contractual fund (CCF) may provide tax transparency depending on the type and jurisdiction of an investor |

| Benchmark | MSCI World (Developed) USD NTR |

| Target Return | Benchmark + 0.7% |

| Administrator | Northern Trust International Fund Administration Services (Ireland) Limited |

| Auditor | EY |

| Legal Counsel | Pinsent Masons (Ireland) |

| Minimum Investment ($ USD) | $25,000,000 |

| Liquidity | Daily |

| Investment Management Fee | Class A – 0.10% pa (minimum $250m) Class B – 0.25% pa (minimum $10m) Class C – 0.30% pa (minimum $500k) Class D (hedged) – 0.25% pa (minimum $10m) |

| Base Currency | USD |

| Investor Type | Individuals not eligible |

IMPORTANT INFORMATION:

Global Investors (ex US). This report is issued in the UK by Osmosis Investment Management UK Limited (“Osmosis”). Osmosis is authorised and regulated by the Financial Conduct Authority “FCA” with FRN 765056. This document is a “financial promotion” within the scope of the rules of the FCA. In the United Kingdom, the issue or distribution of this document is being made only to and directed only at professional clients (as defined in the rules of the FCA) (“Professional Clients”). This document must not be acted or relied upon by persons who are not Professional Clients. Any investment or investment activity to which this document relates is available only to Professional Clients and will be engaged in only with Professional Clients.

US Investors. This document is issued by Osmosis Investment Management US LLC (“Osmosis”). Osmosis Investment Management UK Limited (“Osmosis UK”) is an affiliate of Osmosis and has been operating the Osmosis Model of Resource Efficiency. Osmosis UK is regulated by the FCA. Osmosis and Osmosis UK are both wholly owned by Osmosis (Holdings) Limited (“OHL”). Osmosis Investment Management AUM includes discretionary assets under management of OIM US and OIM UK and assets invested in model programs provided by OIM US and OIM UK.

The Core Equity – Ex Fossil Fuel Fund is not available for US Investors. Separate accounts are available for U.S. investors using the same model and investment objective of the Fund.

Investments like these are not suitable for most investors as they are speculative and involve a high degree risk, including risk of loss of capital. There is no assurance that any implied or stated objectives will be met. This material is provided for illustrative purposes only and is for use in one-on-one presentations only.

This document alone does not constitute: a recommendation by, or advice from, Osmosis or any other person to a recipient of this document on the merits or otherwise of participating in the products, investments and transactions referred to in this document; a guarantee, forecast, projection or estimate of any future returns (or cash flows) on any investment; or investment, tax or other advice. Potential investors should read the relevant fund’s prospectus, or offering memorandum, and consult their own legal, tax, accounting and other professional advisers before making any investment. Prospectuses and EEA key investor information documents for the Osmosis Resource Efficient Core Equity Fund are available in English and may be obtained here or by contacting Osmosis’s registered office.

A decision may be taken at any time to terminate the arrangements made for the marketing of the Fund in any EEA Member State in which it is currently marketed. In such circumstances, Shareholders in the affected EEA Member State will be notified of this decision and will be provided with the opportunity to redeem their shareholding in the Fund free of any charges or deductions for at least 30 working days from the date of such notification. As required under sub-paragraph 2 of Article 4(3) of the CBDR.

Performance.

NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN. An investor’s actual account is managed by Osmosis based on the strategy, but the actual composition and performance of the account may differ from those of the strategy due to differences in the timing and prices of trades, and the identity and weightings of securities holdings.

Gross Performance. Gross Returns are gross of fees and in USD unless indicated otherwise. Gross return results do not reflect the deduction of investment advisory fees. Gross performance results may include the reinvestment of dividends and other account earnings. A client’s return will be reduced by the advisory fees and other expenses it may incur as a client. For example, the deduction of a 1% advisory fee over a 10-year period would reduce a 10% gross return to an 8.9% net return. Please see the specific performance disclosure under each slide for additional details. Our fees are fully disclosed in our Part 2A of Form ADV and may be updated from time to time.

Net Performance. Net returns are net of fees and in USD unless indicated otherwise. Net returns are net of fees, costs and dividend withholding tax. Different fees may apply to a client’s account and a client’s returns may be further reduced by the advisory fee and other expenses incurred in the management of its account. Please see the specific performance disclosure under each slide for additional details. Our fees are fully disclosed in our Part 2A of Form ADV and may be updated from time to time.

Past performance may not be indicative of future results. Different types of investments and/or investment strategies involve varying levels of risk, and there can be no assurance that any specific investment or investment strategy will be profitable. Changes in exchange rates may have an adverse effect on the value price or income of the product. No current or prospective client should assume that future performance will be profitable, equal the performance results reflected, or equal any corresponding historical benchmark index. For reasons including variances in fees, differing client investment objectives and/or risk tolerance, market fluctuation, the date on which a client engaged Osmosis’s services, and any account contributions or withdrawals, the performance of a specific client’s account may have varied substantially from the referenced performance results. In the event that there has been a change in a client’s investment objectives or financial situation, the client is encouraged to advise us immediately. It is important to remember that the value of investments, and the income from them, can go down as well as up and is not guaranteed and that you, the investor, may not get back the amount originally invested. Any forecast, projection or target where provided is indicative only and is not guaranteed in any way. Osmosis accepts no liability for any failure to meet such forecast, projection or target. Past performance is not an indication of future performance.

Investment Examples. The investment examples set forth in this presentation should not be considered a recommendation to buy or sell any specific securities. There can be no assurance that such investments will remain in the strategy or have ever been held in the strategy. The case studies have been selected to be included in this presentation based upon an objective non-performance basis because we believe these are indicative of our strategy and investment process. Nothing herein shall be deemed to limit the investment strategies or investment opportunities to be pursued by Osmosis.

Information pertaining to Osmosis’s advisory operations, services, and fees are set forth in Osmosis’s current disclosure statement (Form ADV Part 2A), a copy of which is available from Osmosis upon request and from the SEC at http://www.adviserinfo.sec.gov./Information regarding OHL is available from us upon request.

Benchmarks. The historical index performance results for all benchmark indexes do not reflect the deduction of transaction, custodial, or management fees, the incurrence of which would have the effect of decreasing indicated historical performance results. Indexes are unmanaged and are not available for direct investment. The historical performance results for all indices are provided exclusively for comparison purposes only and may or may not be an appropriate measure to provide general comparative information to assist an individual client or prospective client in determining whether Osmosis performance meets, or continues to meet, his/her investment objective(s). The referenced benchmarks may or may not be appropriate benchmarks against which an observer should compare our returns.

The MSCI World Index captures large and midcap representation across 23 Developed Markets countries. With 1,645 constituents, the index covers approximately 85% of the free float-adjusted market capitalization in each country.

The MSCI World ex Fossil Fuels Index is based on the MSCI World Index, its parent index, and includes large and mid-cap stocks across 23 Developed Markets (DM) countries*. The index represents the performance of the broad market while excluding companies that own oil, gas, and coal reserves.

The iShares Global Clean Energy ETF (ICLN) seeks to track the investment results of an index composed of global equities in the clean energy sector.