Non-Disclosure+ Campaign

The Environment is not Just a Carbon Issue

We are calling on companies to disclose their environmental data

Our Non-Disclosure+ Campaign seeks to make significant strides in tackling non-disclosure of environmental indicators in some of the world’s largest corporations. With the combined weight of our collective assets behind it and the size of the target companies, we believe this campaign can create positive impact for sustainability at a market-level.

Why are we running this campaign?

Despite increasing disclosure of sustainability information by global corporations, several large companies continue to demonstrate a reluctance to publish environmental performance figures. This prevents us from making useful comparisons of these firms against the market. Osmosis regularly engages with companies to encourage and develop their environmental disclosures, but this year’s Non-Disclosure+ Campaign strives to make a greater impact by seeking support from our clients and collaborating investors. Working with like-minded peers to advocate for broader market-level change can bring vast benefits. By joining forces with fellow investors, many of whom are large institutions at the forefront of the transition to a more sustainable allocation of capital, our Non-Disclosure+ Campaign seeks to make significant strides in tackling nondisclosure of environmental data.

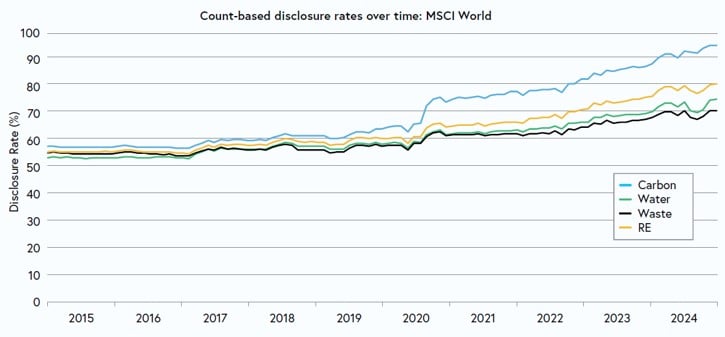

Publicly disclosed corporate environmental data is explicitly integrated into our investment decision–making process. Companies must disclose at least two out of the three metrics – GHG emissions, water withdrawal, and waste generation – to be awarded a proprietary Resource Efficiency score and be given an active weight in our portfolios. Encouraging the disclosure of these metrics and engaging with firms to ensure that such disclosure is trustworthy, accurate, and comparable is, therefore, central to our thesis. Disclosure rates have been improving over the last two decades in the developed markets (Figure 1). However, our in-house team of environmental analysts has identified that 9.81% of the MSCI World (excluding financials and real estate, at 01/08/2024) still do not qualify for a Resource Efficiency score. This represents 217 companies and can be largely attributed to weak water and waste disclosure. Osmosis believes that to gain a comprehensive view of environmental risk, corporations must also address these metrics: the environment is not just a carbon problem.

Figure 1: Osmosis IM, June 2024. Rates of disclosure of environmental metrics and RE scores (2015-2024).

Who are we targeting?

Osmosis plans to engage the top 10 market cap companies (as of 01/08/24) that we have classified as non-disclosing. Non-disclosing firms are those that publish one metric or fewer on carbon emissions, water consumption or waste generation.

Amazon.com

Netflix

Intuitive Surgical

Comcast Corp

Booking Holdings

Fiserv

McKesson Corp

Synopsys

HCA Healthcare

Shopify

Who is supporting the campaign?

This year, we are pleased to be joining forces with a number of like-minded peers and investors to maximise our impact. Supporters of the campaign include, but are not limited to:

Cambridgeshire Pension Fund

PKA Pension Fund

California State Teachers Retirement System (CalSTRS)

Commonwealth Superannuation Corporation (CSC)

Northamptonshire Pension Fund

New York City Employees’ Retirement System (NYCERS)

Hertfordshire Pension Fund