The Environment is not just a carbon issue.

Reducing carbon emissions remains at the forefront of corporate environmental agendas. But carbon emissions should not be the sole indicator of environmental efficiency. Our research demonstrates that a comprehensive approach to addressing the corporate environmental balance sheet – which considers carbon, water and waste – will leave investors less exposed to a broader range of both current and future externality risks.

Why carbon, water and waste?

The role of carbon emissions in fuelling climate change is widely researched, discussed and agreed. As a focal point of past and future regulation, there is no doubt of the relevance of carbon as an indicator of the progress of corporate sustainability practices. Consequentially, the critical issues of water and waste management have been consistently overlooked by companies, governments, and investment firms alike.

Through our research, Osmosis demonstrates that all three metrics pose increasingly meaningful economic risks to corporations. Carbon, water, and waste are all subject to evolving regulation, cost pressure, and social scrutiny. As a result, all three will continue to pose large economic risks to corporations, including physical, reputational, and transitional risks.

Carbon: Level of absolute greenhouse gas emissions from fossil fuel combustion, industrial processes and other sources owned or controlled by the company. Represented as CO2e.

Greenhouse gas emissions are at the forefront of climate related regulation. Carbon emissions are increasingly being priced and regulated by governments, encouraging the ongoing introduction and renewal of policies. In the future, corporations will continue to face stringent regulations, reinforcing the value of carbon to the environmental agenda. Corporations with high carbon emissions may also harm customer relationships, as well as undermine workforce attraction and brand value. As a result, a corporation’s competitive position may be negatively impacted.

Water: Costs generated by purchasing water directly for a company’s operations or from direct water supply companies.

Osmosis research indicates that water management is second to carbon on corporate environmental agendas. Water is a strategic resource for firms, but it faces many challenges, particularly in the context of climate change. These challenges include water scarcity (droughts), disruption of supply (flooding), and deteriorating quality (diffuse pollution). These physical risks may, and do, result in the relocation of business operations away from water-stressed areas, and can cause widespread supply chain disruption. As climate change alters the natural water cycle and increases the frequency of water-related disasters and water-borne diseases, geopolitical tensions over limited resources continue to rise. Incoming regulation is likely to penalise those companies that are water inefficient.

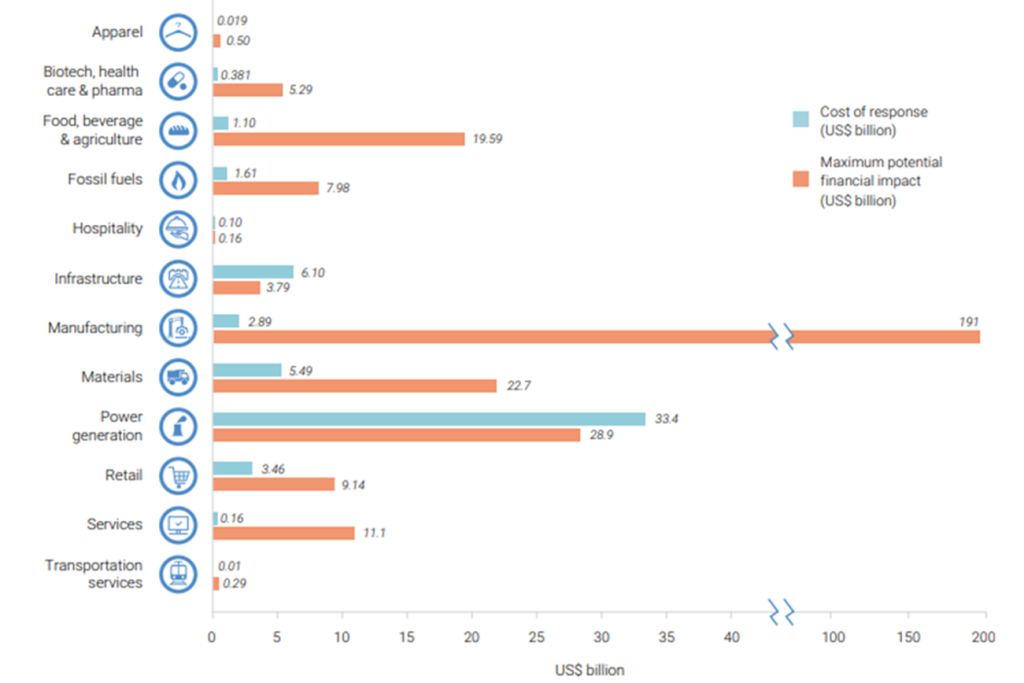

Recent research by the Carbon Disclosure Project highlights the potential financial impact of water risks on a sector level.

Potential financial impact of water risk and cost of response – per sector

Source: Carbon Disclosure Project (2020). The maximum potential financial impact in manufacturing is high in part due to the large number of respondents compared to other sectors and two significant financial impacts (>$50bn) reported one linked flooding, another linked to reputational risk associated with pollution.

Waste: Costs generated from the disposal of waste in normal business operations, classified as landfill, incinerated waste, recycled or nuclear waste.

Waste poses a significant threat to biodiversity, both on land and in oceans, as well as to human health. Additionally, it contributes substantially to anthropogenic climate change through the release of methane from landfill sites. At Osmosis, we believe that the efficient management of resources and the minimisation of waste are essential for fostering a more sustainable and equitable world and driving long-term shareholder value. High waste generation and poor waste management are direct reflections of operational efficiency. They reflect the squandering of valuable resources, resulting in adverse economic, environmental and social impacts. This has been all the more impactful in recent years as the prices of materials and natural resources have risen exponentially, playing havoc with supply chains. As such pressures are likely to continue companies will increasingly view waste management as an economic opportunity. From a profitability perspective, waste prevention and re-use processes should become common place. In the meantime, corporations face increasingly significant reputational risks due to the impact of their waste on the wider environment. Similarly to carbon and water, Osmosis also believes corporations will be targeted by more waste management, reuse, recycling, and disposal regulations.

A three-factor approach delivers a more reliable investment signal

Our research demonstrates it is possible to mitigate a broader range of both current and future externality risks through our three factor approach. It also delivers a more reliable investment signal.

We find that identifying companies with peer-leading efficiency across all three metrics is a more reliable predictor of management commitment than each measurement in isolation. By combining the independent carbon, water, and waste distributions into a single Resource Efficiency signal, our models show that the compounded return differential is more stable and outperforms the carbon-only signal.

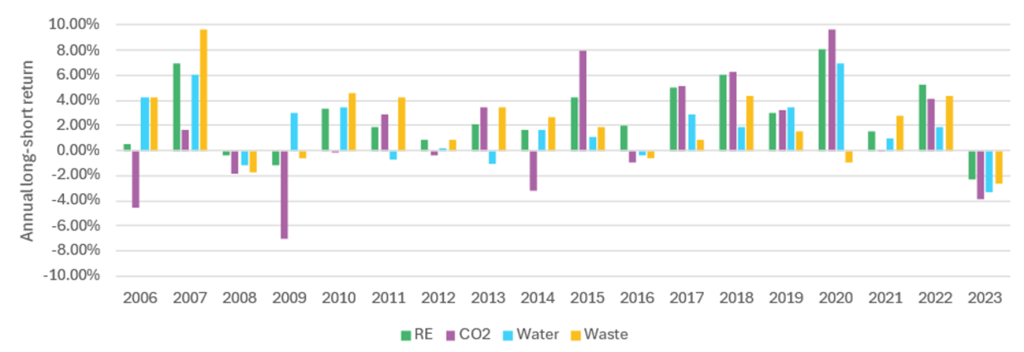

Annual factor performance over time: Efficient-Inefficient

The return values are defined as the long-short annual excess return of the Efficient portfolio over the Inefficient portfolio each year for a given environmental metric (RE, Carbon, Water, Waste). We analysed gross compounded returns with dividends reinvested of companies in the MSCI World (excluding financials & tobacco) during the time period from 31/12/2005 to 31/12/2023. All portfolios are equal-weighted with sector weights forced to be proportional to the benchmark. Source: Osmosis IM, Bloomberg, S&P. Data as at end January 2024. Past performance is not an indication of future performance.

Different components of the Resource Efficiency factor also perform better at different points in time. For example, the carbon signal did poorly in 2006, 2009, 2010 while performing much better in recent years. Waste and water have been more stable signals but sometimes conflict with each other, as shown in 2009, 2011, 2013, 2015 and 2020. The waste and water signals performed well in the early years, whereas the carbon signal has seen strong performance in more recent years, consistent with the current focus on climate change. By combining the three signals into the single Resource Efficiency factor, returns become more stable. In 15 out of the past 17 years, or 88% of the years, the Resource Efficiency premium was positive.

If you would like to learn more about our Resource Efficient portfolios please visit www.osmosisim.com or contact [email protected]

Important Information

None of the company examples referred to above are intended as a recommendation to buy or sell securities.

This document was prepared and issued by Osmosis Investment Research Solutions Limited (“OIRS”). OIRS is an affiliate of Osmosis Investment Management US LLC (regulated in the US by the SEC) and Osmosis Investment Management UK Limited (regulated in the UK by the FCA). OIRS and these affiliated companies are wholly owned by Osmosis (Holdings) Limited (“Osmosis”), a UK-based financial services group. Osmosis has been operating its Model of Resource Efficiency since 2011.

The information is intended only for the use of eligible and qualified clients and is not intended for retail clients. The information does not constitute an offer or solicitation for the purchase or sale of any security, commodity or other investment product or investment agreement, or any other contract, agreement, or structure whatsoever. Recipients are responsible for making your own independent appraisal of and investigations into the products referred and not rely on any information as constituting investment advice. Investments like these are not suitable for most investors as they are speculative and involve a high degree risk, including risk of loss of capital. There is no assurance that any implied or stated objectives will be met. Osmosis has based the information obtained from sources it believes to be reliable, but which have not been independently verified. Osmosis is under no obligation and gives no undertaking to keep the information up to date. No representation or warranty, express or implied, is or will be made, and no responsibility or liability is or will be accepted by Osmosis, or by any of its officers, employees, or agents, in relation to the accuracy or completeness of the information. No current or prospective client should assume that future performance will be profitable the performance of a specific client’s account may vary substantially due to variances in fees, differing client investment objectives and/or risk tolerance and market fluctuations.