Emerging Markets

A New Era of Sustainable Opportunity

A threefold opportunity

For investors, Emerging Markets offer the potential for stronger returns, increased diversification, and real-world impact. Investors who prioritise sustainability in these growing economies can drive tangible progress while positioning their portfolios for growth in a resource-constrained future.

Emerging Markets ETF

The first product in our suite leverages our quantitative model to uncover Emerging Market investment opportunities not fully recognised by the broader market.

Case Study: The Automobiles Sector

As the autos sector shifts towards sustainability, manufacturing remains the largest source of emissions. Leading firms are proving that cutting carbon, water, and waste isn’t just good for the environment, it drives financial performance.

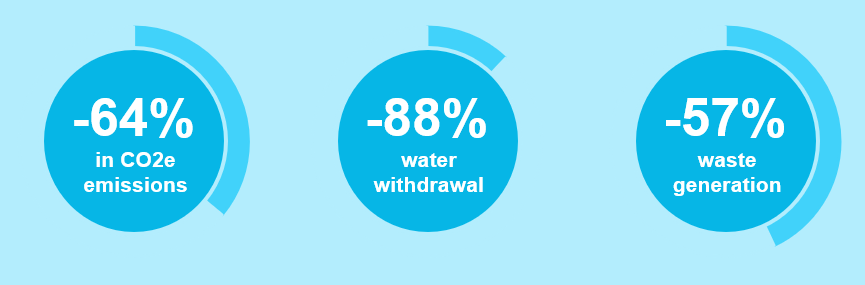

Environmental Footprint

The Resource Efficiency Signal generates a significant reduction in the environmental footprint of our Emerging Markets Strategy relative to the MSCI Emerging Markets benchmark:

Source: Osmosis IM, 30 September 2025

What is Resource Efficiency?

In the absence of consistent environmental reporting standards, Osmosis has pioneered a proprietary approach to the standardisation of unstructured corporate environmental data. Our in-house research team are sector specialists and utilise decades of environmental experience to standardise carbon, water and waste data to environmental economic frameworks, across 34 independent sectors.

Want to stay up to date with our Emerging Markets insights?

Strategies in Focus

Emerging Markets Core Equity Transition

Leveraging our quantitative model to uncover emerging market investment opportunities not fully recognised by the broader market.

Developed Core Equity Transition

Our flagship Strategy was developed to reduce the environmental impact of a client’s core passive holding, while managing the active risk that’s brought into the portfolio.

Core Equity Fossil Fuel Transition

Excludes companies with a material involvement in (i.e. deriving greater than 5% of their revenues from) the fossil fuels industry or nuclear power generation.