Overview

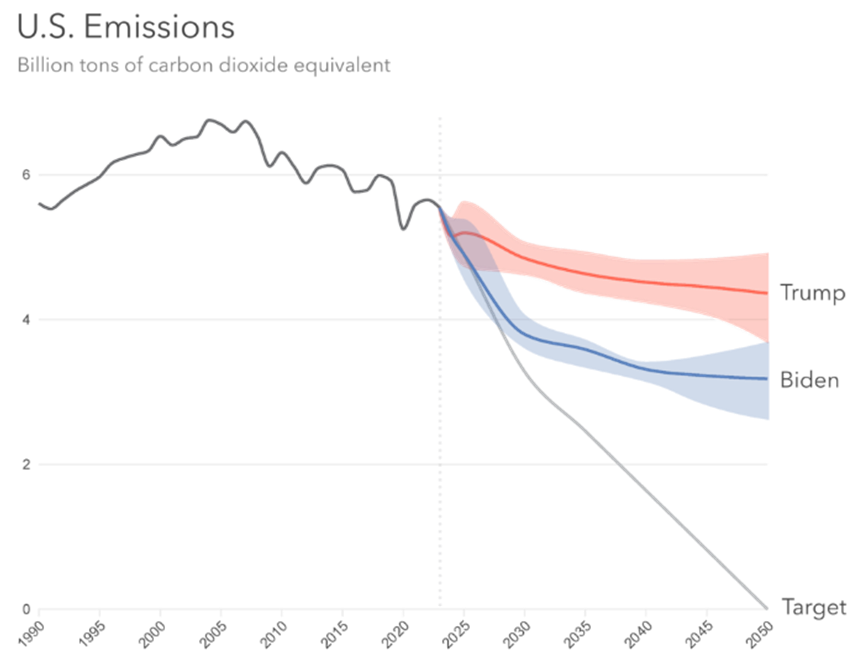

The return of Donald Trump to the presidency poses significant implications for environmental and climate policies, as well as global efforts to combat climate change. As a known climate sceptic, Trump’s administration is expected to prioritise fossil fuel development, deregulation, and reduce participation in international climate agreements.

This approach represents a marked reversal from the progress made under President Biden, potentially undermining national and international climate goals. Trump’s first administration saw significant rollbacks on environmental protections, including withdrawal from the Paris Agreement and relaxed regulations on methane emissions. His second term could deepen these changes, further destabilising global climate efforts.

International Climate Commitments

Paris Agreement Withdrawal: On his first day in office, Trump signed an order to withdraw the U.S. from the Paris Agreement, citing unfair economic burdens, particularly compared to nations like China. The withdrawal process will require a year to take effect, however raises concerns of a potential “domino effect” where other nations reduce their commitments, jeopardising global momentum for climate action. A similar precedent occurred in 2017 when Australia delayed increasing its Paris Agreement targets due to uncertainty about U.S. leadership.

Critics argue that exiting the Paris Agreement diminishes U.S. influence, ceding leadership in the clean energy sector to other countries. For example, China has significantly ramped up its investment in renewables, and the U.S. absence could solidify its dominance in green technologies. Even major corporate figures, such as ExxonMobil’s CEO, have underscored the importance of U.S. participation to shape global climate policies.

Reactions from Other Nations and International Bodies:

- European Union (EU): EU leaders have reaffirmed their commitment to the Paris Agreement, with EU chief Ursula von der Leyen emphasizing continued climate action. French President Emmanuel Macron and Chinese President Xi Jinping have announced plans to strengthen EU-China collaboration on climate issues, which could offset U.S. withdrawal.

- United Nations (UN): UN Climate Change Executive Secretary Simon Stiell highlighted that the global energy transition remains “unstoppable,” emphasising the need for continued international collaboration.

- China: China’s Foreign Ministry expressed its disappointment but reaffirmed its commitment to upholding the Paris Agreement’s objectives. Beijing’s leadership could intensify in the absence of U.S. participation, as seen at COP29.

- Developing Nations: Representatives from vulnerable nations raised concerns about the moral and environmental implications of the U.S. decision, emphasising the disproportionate impact on communities already facing severe climate challenges.

UN Framework Convention on Climate Change (UNFCCC): The future of agreements made during COP29 is uncertain under Trump’s administration. The minimal Republican representation at COP29 underscores a lack of bipartisan support, potentially weakening international climate cooperation. Ongoing projects and initiatives tied to the UNFCCC, such as the $100 billion climate finance goal, may lose momentum without U.S. leadership.

Key Appointments and Governance

Energy Secretary: Chris Wright

- Background: Fossil fuel executive, fracking advocate, and climate change denier with no prior governmental experience.

- Policy Stance: Supports “energy dominance” through oil and gas expansion.

- Environmental Impact: Expected to hinder the U.S. transition to renewable energy by prioritising fossil fuels over clean technologies.

Environmental Protection Agency (EPA) Administrator: Lee Zeldin

- Background: Politically experienced with strong ties to fossil fuel interests; known for pro-coal and pro-gas positions.

- Policy Stance: Advocates deregulation, reduced environmental oversight, and withdrawal from the Paris Agreement.

- Structural Changes: Trump aims to defund the EPA, leveraging Supreme Court rulings that have limited the agency’s regulatory authority.

Department of Government Efficiency: Elon Musk

- Role: Tasked with reducing government waste, Musk introduces a complex dynamic.

- Climate Stance: While Musk supports renewable energy and carbon taxes and understands the threat of climate change, it remains uncertain whether his influence can shift Trump’s environmental stance.

Interior Secretary: Douglas Burgum

- Background: Former Governor of North Dakota, known for supporting fossil fuel development and deregulation.

- Policy Stance: Expected to promote energy exploration on public lands, potentially at the expense of environmental protections.

Commerce Secretary: Howard Lutnick

- Background: CEO of Cantor Fitzgerald, with expertise in financial services but limited experience in environmental issues.

- Policy Stance: Likely to prioritise economic growth over environmental considerations, potentially impacting trade in clean energy technologies.

Agriculture Secretary: Brooke Rollins

- Background: Former Director of the Domestic Policy Council, with a focus on rural development and agricultural deregulation.

- Policy Stance: Likely to advocate for deregulation and policies favouring industrial agriculture over sustainability initiatives.

Transportation Secretary: Sean Duffy

- Background: Former Congressman from Wisconsin, with limited transportation policy experience.

- Policy Stance: Expected to support deregulation and redirect funding from sustainable transportation projects. He is also vocally against Biden’s support of electric vehicles.

Trump’s Domestic Energy Policy

Fossil Fuel Expansion: Trump’s administration prioritises domestic oil and gas production to achieve energy independence, with initiatives such as:

- Accelerating approvals for coal and gas power plants.

- Lifting restrictions on public land drilling and reducing biodiversity protections.

- Expanding oil reserves.

Methane Emissions: Plans to eliminate fees on methane leaks imposed by the Inflation Reduction Act (IRA), potentially increasing greenhouse gas emissions.

Liquefied Natural Gas (LNG): Biden’s pause on LNG export permits is likely to be reversed, slowing renewable energy efforts.

Halting Wind Energy Projects: Trump signed an executive order suspending leasing and permitting for both onshore and offshore wind energy projects, pending a review of their environmental and economic impacts. This move aligns with the administration’s emphasis on fossil fuel dominance.

Unleashing American Energy Initiative: The “Unleashing American Energy” executive order aims to simplify permitting processes for energy projects, revoking directives that emphasised environmental considerations. This policy further accelerates fossil fuel development.

Biden’s Inflation Reduction Act (IRA)

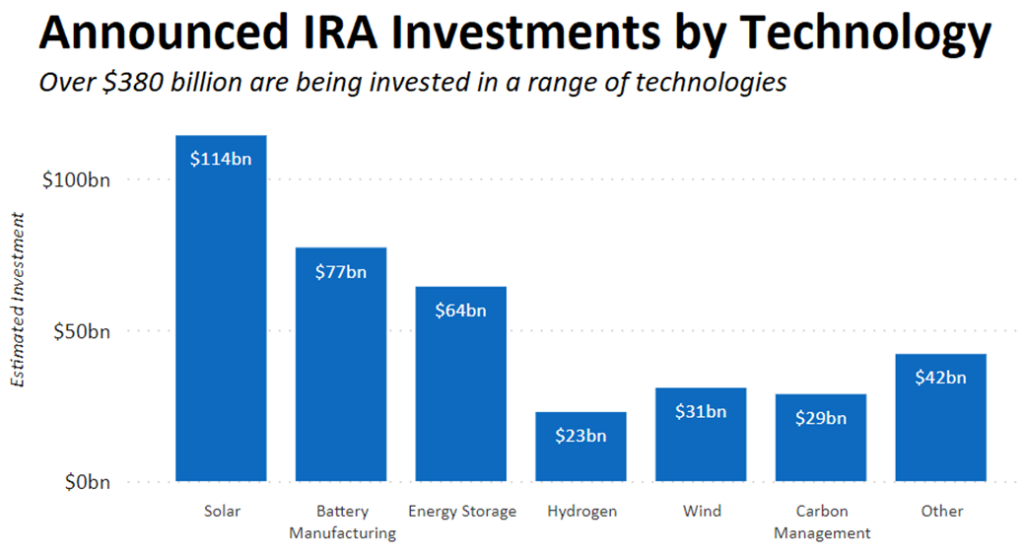

Impact and Repeal Efforts: The IRA marked a historic investment in clean energy and technology, creating over 400,000 jobs and generating $422 billion in investments. On his first day in office, Trump directed federal agencies to halt spending associated with the Act. This move comes as no surprise, given his earlier pledge to repeal the IRA, particularly its provisions supporting electric vehicles. Trump hopes to rescind unspent IRA funds, including the $142.3 billion allocated for climate grants and clean energy incentives. The IRA however contains provisions on where funds are specifically allocated. Therefore, attempts to rescind, reallocate, or claw back funds could be violations and will be subject to court challenges.

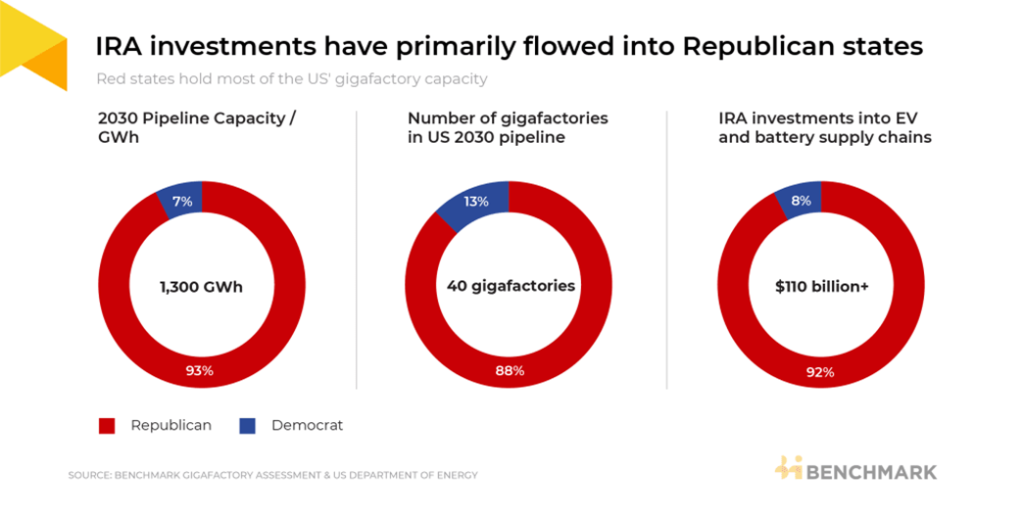

Opposition to Repeal: Even Republican lawmakers may resist repeal efforts, given that red states have disproportionately benefited from IRA investments, receiving over 92% of the $110 billion invested in EV and battery supply chains. These investments have also created 36% of the new clean energy jobs, predominantly in southern, republican states such as Texas and Virginia.

International Relations and Trade

China Tariffs: Trump plans to impose tariffs of up to 40% on Chinese imports, potentially disrupting access to clean technology essential for the renewable energy transition. Such measures could hinder progress toward U.S. low-carbon goals, however they have already been ramped up by Biden, who added 100% tariffs to imported Chinese EVs and increased tariffs on critical minerals and solar panels.

EU- China Relations: Potential withdrawal from climate agreements may strengthen EU-China collaborations, further isolating the U.S. on the global stage.

Potential Impacts and Mitigation

Environmental Rollbacks: Repealing key Biden-era regulations could increase U.S. greenhouse gas emissions by an estimated 4 billion tonnes by 2030. Federal protections for endangered species and ecosystems are likely to be reduced to prioritise industrial development.

Corporate and State-Level Resistance:

Major corporations and state governments may continue clean energy initiatives independently of federal policies. In addition, shareholder activism and environmental group litigation are expected to intensify, as seen during Trump’s first term.

It is crucial to note that pro-climate states have acted swiftly to reiterate their commitment to net-zero and Paris alignment, despite Trump’s withdrawal from the agreement. The US Climate Alliance, a group of 24 U.S. state governors, primarily from the Democratic party, have offered a statement of intent that they remain committed to the U.S.’s Paris Agreement goals. As the alliance accounts for over half of the U.S. population and economy, the commitment of these individual states to combat climate change will become invaluable in upcoming years as federal efforts are significantly reduced under Trump.

Renewable Energy Resilience: Bipartisan support for clean energy investments, particularly in Republican-led states due to the IRA, may sustain growth in the sector despite federal setbacks.

ESG Funds and Investments

State-Level Restrictions: During Trump’s first term, red states like Texas enacted laws restricting municipalities from engaging with financial institutions adopting ESG-focused policies against fossil fuels. This led to major underwriters like JPMorgan Chase and Goldman Sachs exiting those markets. Whilst these laws are state-specific and there has been no mention of federal or nationwide measures to the same effect, they are still disruptive to municipal access to capital in affected areas and other red states like Oklahoma and West Virginia are also considering similar laws.

Potential Expansion: A broader anti-ESG stance could gain traction under a Trump administration, potentially deterring institutional investments in sustainable projects and disrupting the growth of ESG-aligned funds.

Financial Institution Response

Hostile Regulatory Environment: It is notable that in recent months, major financial institutions have withdrawn from prominent climate alliances such as the Net Zero Banking Alliance (NZBA), Net Zero Banking Zero Asset Managers (NZAM) and Climate Action 100+ (CA100+). In the past two months, six major U.S. banks have quit the NZBA just before Trump’s inauguration, likely anticipating a regulatory environment hostile to climate commitments. This withdrawals have caused a domino effect with four of Canada’s biggest banks also withdrawing ahead of Trump’s return.

Shift to Weaker Climate Commitments: In their withdrawals, many financial institutions have reiterated their commitment to the Glasgow Financial Alliance for Net Zero (GFANZ). It is significant that GFANZ has abandoned the requirement that members be aligned to the Paris agreement as Trump takes office.

Explanations for the Exits: In their exit statements, financial institutions cited concerns over legal risks or disagreements with alliance standards. BlackRock and State Street, for example, faced a lawsuit from Texas Attorney General relating to their participation in the NZAM, contributing to their exit from the alliance. Following BlackRock’s exit the organisation has since suspended its activities. Such reasoning has highlights the growing influence of political pressures on corporate climate action.

| Institution | Region | Action | Quote |

| JPMorgan Chase | USA | Exited NZBA and CA100+ | JPMorgan stated that whilst it has left the NZBA, it would “continue engaging with GFANZ, among others” to promote a “low-carbon and energy-secure future.” |

| Citigroup | USA | Exited NZBA | Citi stated its shift from the NZBA to GFANZ was due to its new focus on “mobilizing capital to emerging markets in support of the low-carbon transition.” |

| Bank of America | USA | Exited NZBA | A Bank of America spokesperson said, ‘We will continue to work with clients on this issue and meet their needs.'” |

| Goldman Sachs | USA | Exited NZBA | Goldman Sachs did not provide a specific public statement regarding its withdrawal. |

| Morgan Stanley | USA | Exited NZBA | Morgan Stanley did not specify reasons for its departure. |

| Wells Fargo | USA | Exited NZBA | Wells Fargo did not provide a specific public statement regarding its withdrawal. |

| Bank of Montreal (BMO) | Canada | Exited NZBA | Despite the withdrawal, BMO reaffirmed its commitment to its “climate strategy” and to supporting clients in their “transition to a net-zero world.” |

| BlackRock | Global | Exited NZAM | BlackRock cited “legal inquiries from various public officials” and confusion over its practices as reasons for its exit. |

| Vanguard | Global | Exited NZAM | Vanguard stated that whilst initiatives like NZAM can advance constructive dialogue, they “sometimes result in confusion about the views of individual investment firms.” |

| Baillie Gifford | UK | Exited CA100+ and NZAM | Stated that membership had become “contested”, and that risked ”distraction from core responsibilities.” |

| Northern Trust Asset Management | USA | Exited CA100+ and NZAM | The firm expressed confidence in independently managing material risks and engaging with portfolio companies. |

| Invesco | USA | Exited CA100+ | Invesco stated it believed clients’ interests were better served through its own engagement approach. |

| State Street Global Advisors | USA | Exited CA100+ | Similar to other U.S. firms, State Street left the initiative after facing scrutiny and potential legal challenges. |

| PIMCO | USA | Exited CA100+ | PIMCO stated CA100+ is not aligned with their approach to sustainability. |

Conclusion

The return of Trump’s administration signifies a significant shift in U.S. environmental policy, with substantial risks to both domestic clean energy progress and global climate efforts. However, resistance from corporations, state governments, and international bodies may temper these effects, ensuring some continuity in the fight against climate change. Global momentum in renewable energy and market-driven demand for sustainable solutions may ultimately provide a counterbalance to federal rollbacks, keeping climate goals within reach despite challenges.

Moreover, the reaction of pension funds will be critical. With their longer-term investment horizons and recognition that political changes are transitory, these funds understand that delaying action on pressing environmental issues exposes their portfolios to significant risks. Pension funds should remain committed to a sustainable, just, and pragmatic transition. Additionally, financial firms that have acknowledged the insufficiency of some climate-related bodies they joined are expected to uphold their societal commitments. Should they fail to do so, they may face penalties from investors through redemptions in the short to medium term.

Important Information

None of the company examples referred to above are intended as a recommendation to buy or sell securities.

This document was prepared and issued by Osmosis Investment Research Solutions Limited (“OIRS”). OIRS is an affiliate of Osmosis Investment Management US LLC (regulated in the US by the SEC) and Osmosis Investment Management UK Limited (regulated in the UK by the FCA). OIRS and these affiliated companies are wholly owned by Osmosis (Holdings) Limited (“Osmosis”), a UK-based financial services group. Osmosis has been operating its Model of Resource Efficiency since 2011.

The information is intended only for the use of eligible and qualified clients and is not intended for retail clients. The information does not constitute an offer or solicitation for the purchase or sale of any security, commodity or other investment product or investment agreement, or any other contract, agreement, or structure whatsoever. Recipients are responsible for making your own independent appraisal of and investigations into any products offered and not rely on any information as constituting investment advice. Osmosis investments are not suitable for most investors as they are speculative and involve a high degree risk, including risk of loss of capital. There is no assurance that any implied or stated objectives will be met. Osmosis has based the information obtained from sources it believes to be reliable, but which have not been independently verified. Osmosis is under no obligation and gives no undertaking to keep the information up to date. No representation or warranty, express or implied, is or will be made, and no responsibility or liability is or will be accepted by Osmosis, or by any of its officers, employees, or agents, in relation to the accuracy or completeness of the information. No current or prospective client should assume that future performance will be profitable the performance of a specific client’s account may vary substantially due to variances in fees, differing client investment objectives and/or risk tolerance and market fluctuations.