A Smarter Approach to Fossil Fuel Divestment

Balancing Financial Performance and Fiduciary Duty

Departing from the Traditional Approach

The Strategy uniquely addresses both the supply side of fossil fuel energy generation through fossil fuel divestment, while addressing the demand side of fossil fuel energy consumption by reallocating the active divestment risk to the most highly correlated Resource Efficient companies across the whole economy.

Divestment Challenges: Missed Opportunities & Re-inclusion

A frequently overlooked challenge of fossil fuel divestment is the

potential to miss out on transition opportunities. By divesting

completely, investors might forgo the chance to support and benefit

from companies that are actively transitioning toward cleaner

energy.

Strict Environmental Screens

- Exclude companies with >5% of their revenues from fossil fuels or nuclear power (subject to re-inclusion policy).

- Exclude companies with any ties to thermal coal or oils sands usage

- Exclude companies in breach of any of the 10 principles of the UN Global Compact

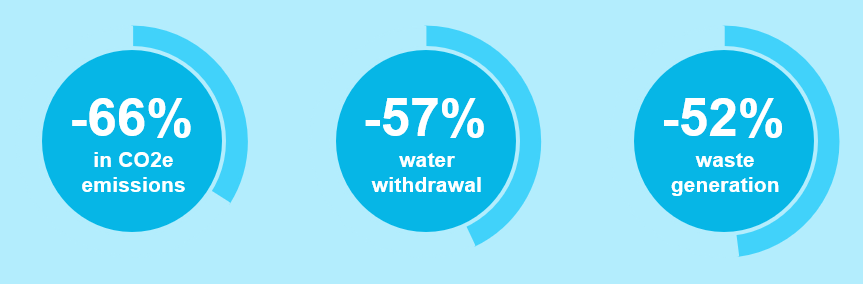

Environmental Footprint

The Osmosis Resource Efficiency Signal generates a significant reduction in the environmental footprint of our Fossil Fuel Transition Strategy relative to the MSCI World benchmark (as at end March 2025):

What is Resource Efficiency?

In the absence of consistent environmental reporting standards, Osmosis has pioneered a proprietary approach to the standardisation of unstructured corporate environmental data. Our in-house research team are sector specialists and utilise decades of environmental experience to standardise carbon, water and waste data to environmental economic frameworks, within 34 independent sectors.

Our Core Equity Range

Developed Core Equity

Our flagship Strategy was developed to reduce the environmental impact of a client’s core passive holding, while managing the active risk that’s brought into the portfolio.

Core Equity Fossil Fuel Transition

Excludes companies with a material involvement in (i.e. deriving greater than 5% of their revenues from) the fossil fuels industry or nuclear power generation.

Core Equity Fossil Fuel Transition (Aus Trust)

Excludes companies with a material involvement in (i.e. deriving greater than 5% of their revenues from) the fossil fuels industry or nuclear power generation.