Robbie Parker, Chief Investment Officer – Osmosis Investment Management

Assessments of the expected performance gains or losses from focusing on climate-friendly, or green, firms are published increasingly frequently and, if you dig deeply enough, you can find a conclusion that fits your bias. Unhelpfully, the analysis is usually limited to US stocks. It might be big and beautiful to some, but the US stock market isn’t everything; many observations in the US fail to transport into other markets – the dividend Aristocrats is just one example.

More usefully, analysis published at the end of last year[1] had a broader perspective. It examined US, developed ex US, and emerging markets pursuing a consistent relationship between greenhouse gas emissions and stock returns. The authors found emission intensity, emission level, or change in emission level provided limited additional information about future profitability beyond what is already known. This inconclusive result extended to there being no reliable relationship between the emission metrics examined and average stock returns; there was some indication of a reliable excess return within developed ex US markets. They looked also at US corporate bonds and found an equally weak result.

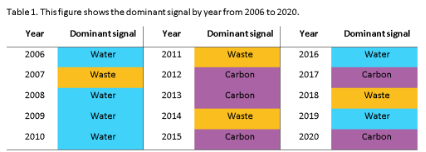

These conclusions highlight the importance of adopting a broader environmental perspective. Our data shows that only in five of the fifteen years since the end of 2005 has the carbon metric been the dominant alpha signal. More frequently, firm-published water consumption data has been associated with the superior investment outcome. Data highlighting the least wasteful companies has further improved results.

Only in five of the fifteen years since the end of 2005 has the carbon metric been the dominant alpha signal

In a recent report that looked at consumer staples companies, Barclays found that water factors were likely to have a greater impact than carbon reduction strategies and that the cost of inaction on water exceeds that cost of action by a factor of eighteen. More broadly, they judged that globally, the financial impact of water shortages is three times that associated with carbon emissions. It is straightforward then to conclude that a better approach to environmental investing is to combine analysis of as many aspects as possible.

One of the more positive aspects of the first research report mentioned was the prospect that future inflows, into suitably focused funds, could yet drive a positive relationship with stock performance. The authors analysed data between 2009 and 2018. Since 2018, ESG-related inflows have grown exponentially and with the strong focus on carbon emissions it is unsurprising that we find stock returns in 2020 to be driven most by carbon data. Weight-of-money could ensure that carbon continues to be the dominant signal. Equally, the focus could soon shift.

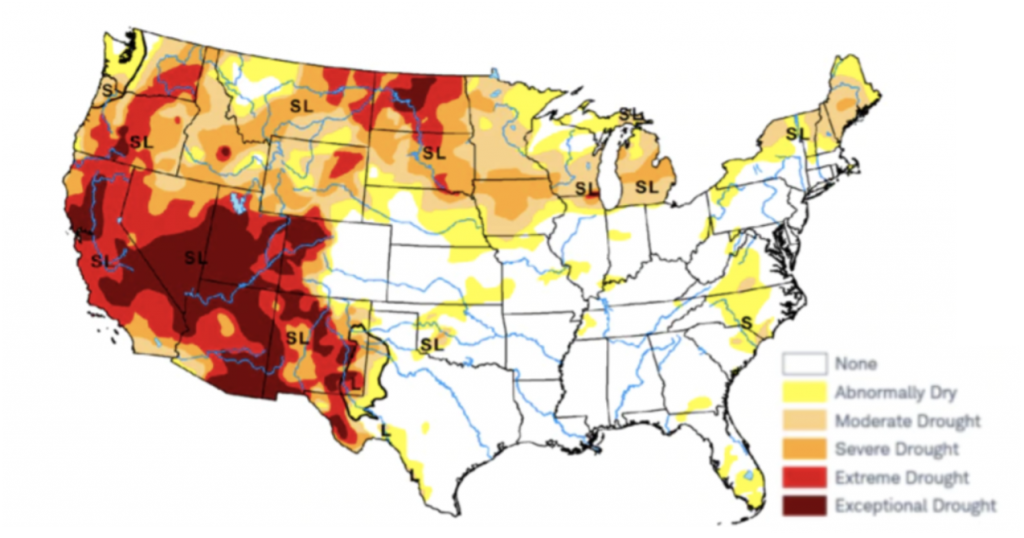

The New York Times recently wrote about a US mega-drought[2]; the current US Southwestern driest 20-year period since the late 1500s. The Times, following a piecearguing that Iran had run out of water[3], wrote recently on the prospect of nations going to war over access to water. Barclays highlighted that, in some parts of India, water prices for companies have risen 800-fold.

While heavy carbon emission is a slow-burn issue that Governments and markets struggle with, water shortage has a unique immediacy. Businesses, charged with careless consumption in a world where people are dying of thirst, can quickly fall out of favour or face harsh penalties. With this backdrop, environmentally conscious investors need to analyse water usage data with a focus that matches that on emissions.

While heavy carbon emission is a slow-burn issue that Governments and markets struggle with, water shortage has a unique immediacy

We see numerous examples of companies that have sharply lowered their water consumption relative to revenue, while delivering investment outperformance relative to their sector peers.

General Mills has been using an enterprise-wide integrated system to gather data from all their facilities every month enabling rapid reporting and analysis; this data is combined with utility invoices, laboratory reports and other similar documentation.

Hitachi identified three plants in China, India, and the United States located in areas of water stress and changes implemented led to a 11% decrease in water consumed; across the company, water intake is being reduced by increasing the use of recycled water.

Anglo American has used a Water Efficiency Target Tool to halve its water intensity since 2016.

Source: Osmosis Investment Management, Model of Resource Efficiency

In recent years, carbon has dominated the environmental debate and emissions-minded investors have found reward. The most consistently successful companies are nonetheless likely to be those that meet the environmental challenge across a broad front. Investors should do likewise.

Important Information

The investment examples set forth in this article should not be considered a recommendation to buy or sell any specific securities. There can be no assurance that such investments will remain in the strategy or have ever been held in the strategy. The case studies have been selected to be included in this presentation based upon an objective non-performance basis because we believe these are indicative of our strategy and investment process. Nothing herein shall be deemed to limit the investment strategies or investment opportunities to be pursued by Osmosis. Past performance may not be indicative of future results.

Any views expressed are those of Osmosis only and should not be construed as investment advice or in any way recommending a specific security.

Osmosis Investment Research Solutions Limited (CRN 09935396)

] https://ssrn.com/abstract=3714874

[2] https://www.nytimes.com/article/what-is-a-megadrought.html

[3] https://www.thetimes.co.uk/article/iran-fast-running-out-of-water-says-exiled-expert-after-deadly-protests-mt3gdndc3