Central Banks got unlucky…perhaps, but if it hadn’t been for the covid crisis, and now also the Russia/Ukraine crisis, what would have caused the never-ending supply of free money?

Quantitative tightening was tested in 2013 and again in 2018 by the Federal Reserve (Fed) but on both occasions, a balking market caused a swift reversal back to the printing press. With asset prices on a permanent upcycle, the “everything rally,” (which saw positive correlations between equities and bonds), lasted a staggering period. The positive correlation has unfortunately for many investors held on the way back down as the dim reality of rampant inflation, and the subsequent tightening by respective central banks, has created bear markets in all but commodities and USD. Is the current bout of inflation finally going to put an end to the experiment? The disease has been diagnosed but has the cure been found? With markets experiencing prolonged volatility, and intraday reversals being driven on speculation of a pause or a pivot, central bankers are caught between the devil and the deep blue sea, which in our opinion is a slightly more challenging place to be than the rock and a hard place.

The S&P 500 is down 24% year to date. And while the FTSE and Topix look brighter on a local currency basis, a conversion to USD shows the extent to which currencies have weakened against the Greenback. Regardless of currency though, the Eurostoxx has lost significant value year to 30 September (-22% EUR). The USD has appreciated 21%, 16% and 26% respectively against GBP, EUR, and JPY. While such aggressive tightening by the Fed may be appropriate for the US economy, the consequences across Europe and Asia, should a similar path be followed, may come at the cost of growth. A soft landing seems unlikely.

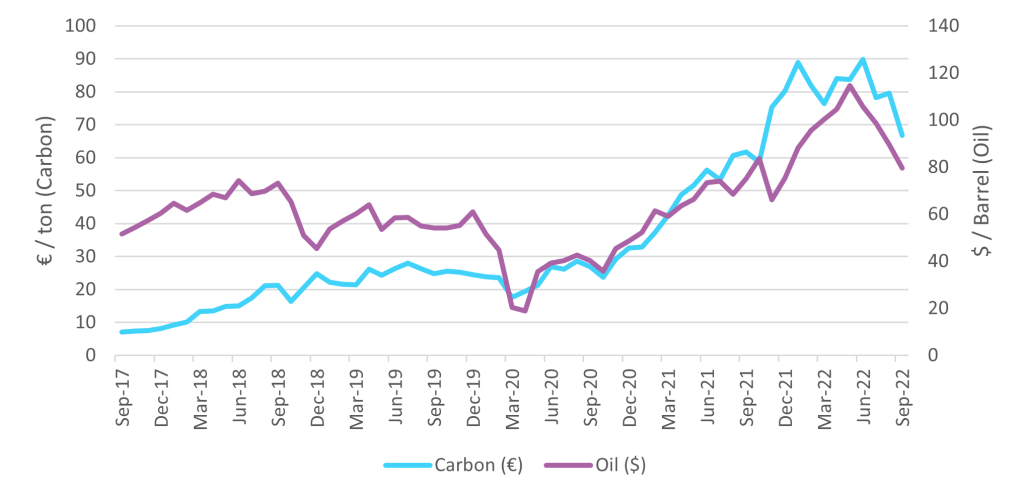

Meanwhile, we have seen record carbon pricing, with the Euro carbon price hitting 100 euros before drawing back to end the quarter at 67 EUR per tonne. We saw similar effects in the oil price and general commodity prices as they reached levels not seen since pre the global financial crisis. Assets on the continent that were previously “stranded” have been given a lifeline. Mothballed coal fired power plants have been re-activated as the short-term energy crisis is prioritised over environmental consequence. Whilst the current pressures are understandable, reversals on climate policy will only kick the can further down the road and the future costs of the climate crisis will compound for future generations to pick up the tab.

The current re-valuation of the equity markets was inevitable against such a backdrop, but through this repricing there will of course be opportunities to invest at more attractive valuations. As interest rates have risen, there is now a genuine cost of capital and thus companies will have to generate excess value above and beyond a hurdle rate that has for so many years been effectively zero. Not only this, but debt will also have to be rolled with debt-driven share buy-backs resigned to the history books. Fundamentals might well be coming back into fashion.

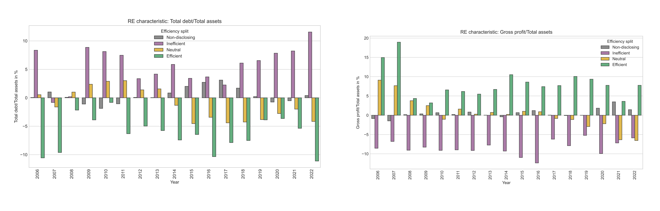

This recent period of inflation, heavily driven by rising energy costs, has also given us a unique perspective on the energy transition. Not only must we accelerate the transition away from fossil fuels, but our consumption patterns must also adapt. If governments continue to roll back their climate agendas to deal with this short-term pain, the imperative to focus on both the supply and demand of energy will be essential to quicken the pace of transition, to close the gap. Our factor of Resource Efficiency identifies management teams that have adapted their business models on a sector-relative basis, across the whole economy, effectively positioning client assets to address both the demand and supply side of the equation. The bigger the gap through any policy errors, the greater the impact will need to be – positioning now is we believe a sensible way to be tilting portfolios.

In tandem, Resource Efficient companies (as identified by our model) continue to maintain and increase their respective margins whilst remaining under levered to their more intensive peers. Corporate earnings revisions have been coming quick and fast as the macroeconomic reality starts to impact corporate income statements. Ultimately, those with the strongest balance sheets will be able to weather the storm, and as we see continued supply constraints in the commodities market, we believe those companies that have best future proofed their business models (which we identify through our unique Resource Efficiency lens), will be those best placed to take advantage.

There has been much debate around the effectiveness of ESG in sustainable finance circles of late, and concerns of greenwashing and underperformance are dominating the headlines. At Osmosis we believe fundamental sustainability has unique short-term and long-term opportunities, and this is demonstrated in our consistent ability to deliver risk-adjusted returns with a significant beneficial environmental outcome. But it is true that not all sustainability strategies are made equally, and many approaches continue to operate in the absence of risk controls. All too often, such sustainability strategies are too easily defined by growth biases and industry active exposures. Despite our belief that such products have little real-world economic reality, the very definable risks they bring in, with little sustainability consequence, calls for further scrutiny.

Integrating sustainability will remain crucial for the long-term success of equity programs. Uncontrolled risks will unfortunately be the demise of most. As our core equity program highlights, financial and environmental performance need not be mutually exclusive, as despite the strains and volatility, sustainability can be rewarded by the markets.

Past performance may not be indicative of future results. Different types of investments and/or investment strategies involve varying levels of risk, and there can be no assurance that any specific investment or investment strategy will be profitable. IThis information may contain projections or other forward-looking statements regarding future events, targets, forecasts or expectations, and is only current as of the date indicated. There is no assurance that such events will be achieved, and actual results may be significantly different from those noted here