With recent GDP numbers coming out better-than-expected, have Central Banks achieved what most people thought was impossible and orchestrated a soft landing? Alas, we feel this is unlikely, despite what equity markets might like us to believe. While investors obsess over the pivot or peak interest rates, there have been countless warnings from the corporate community that point towards more serious stress to come.

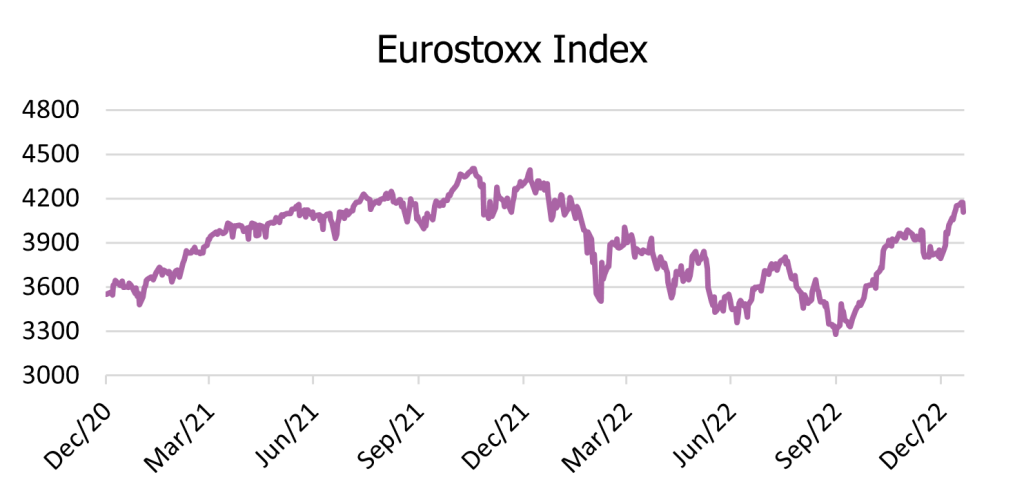

Despite the uncertain backdrop, the Eurostoxx has risen by 14.33% in EUR terms, significantly outperforming the S&P 500 during the last quarter of 2022. The relief of a warm winter has helped, and with gas storage tanks remaining remarkedly topped up, Germany proving that infrastructure projects need not take years with LNG terminals built in record time, wholesale prices have fallen faster than analysts predicted.

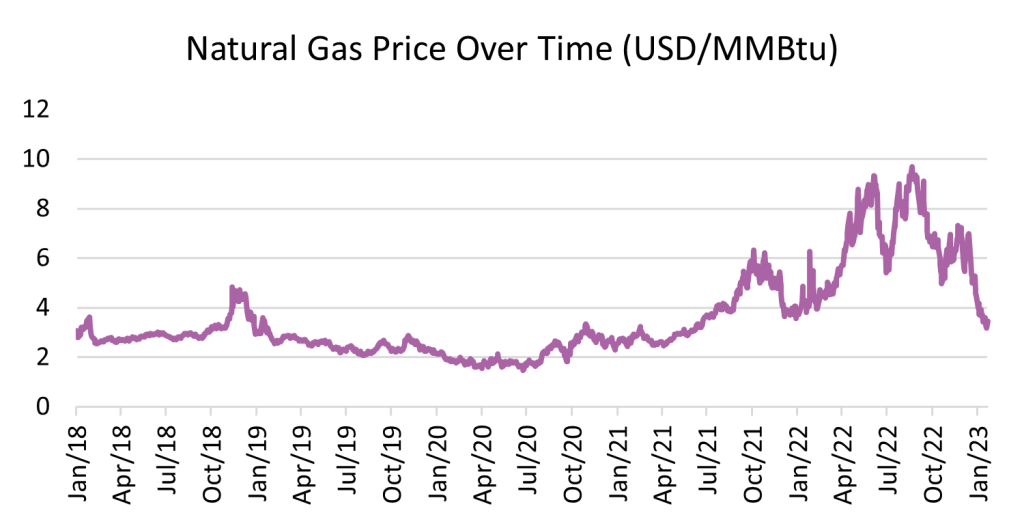

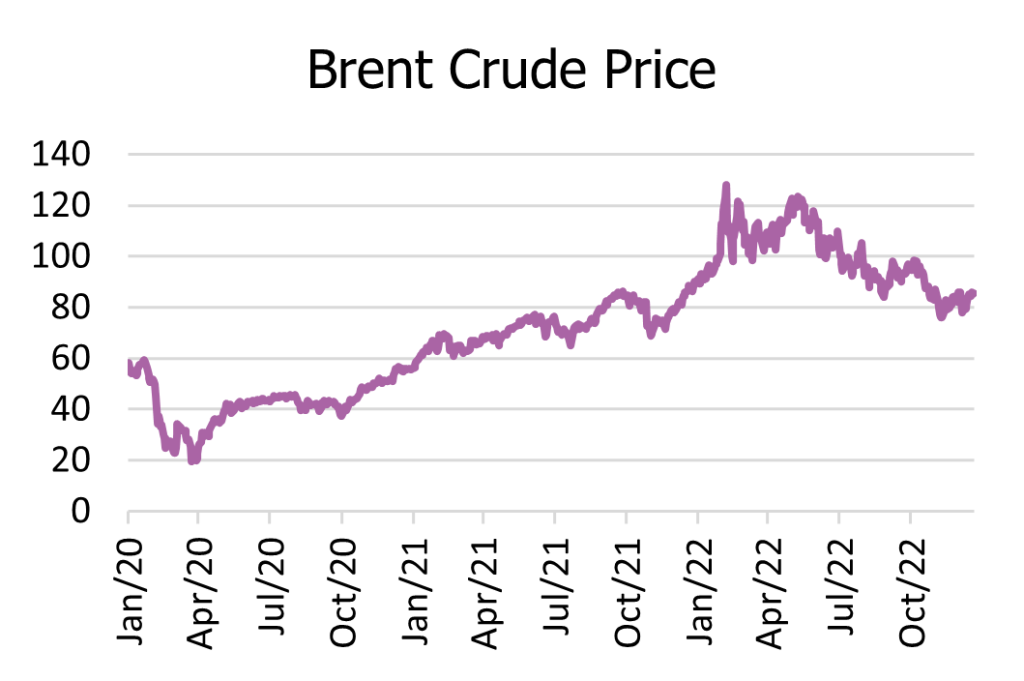

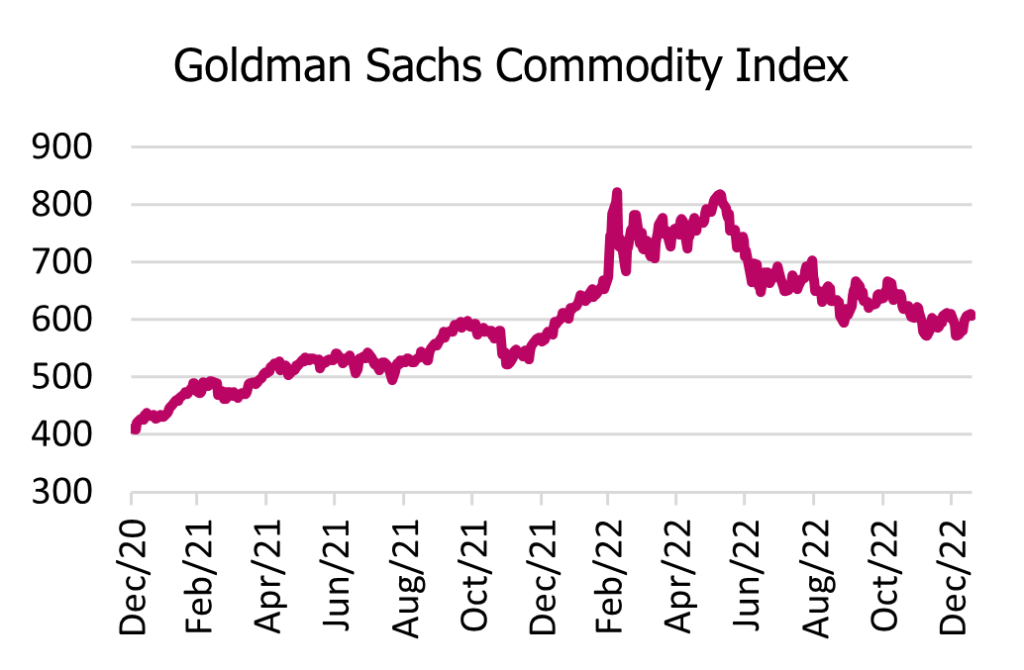

Sadly, such positive news is likely short-lived. Company financial reports are beginning to roll out, and they may well tell a different story. It will be interesting to see whether the pattern of resilient reporting we witnessed in 2022 can continue, particularly against the backdrop of a risk-free rate that is reverting to historical norms. In tandem, we are seeing a re-opening of the Chinese economy. The impact of their zero covid policy and reopening remains a mystery for now; however, focusing on oil prices and general commodity prices leaves us with no doubt that inflation woes will not remain subdued for long. The US employment rate remains persistently strong, and whilst the market continues to test the Fed’s resolve, Powell has held steadfast in his attempt to dampen inflation. With a reopening of China, the pressure on oil prices is likely also to gather pace, and we could see a march higher in Q1, which, combined with a rally in other commodities, will only seek to keep inflation persistently higher for longer.

Meanwhile, environmental concerns appear to have been put on the back burner. COP27 in Egypt had some strong and much-needed commitments around biodiversity, but for climate, it was another opportunity missed. The annual climate conference ended with no agreement to phase out coal and other fossil fuels, nor did it set a target for peak emissions. Furthermore, the energy crisis in Europe has boosted the short-term opportunities for fossil fuel assets as energy companies such as Germany’s RWE extended the life of coal power plants over the quarter.

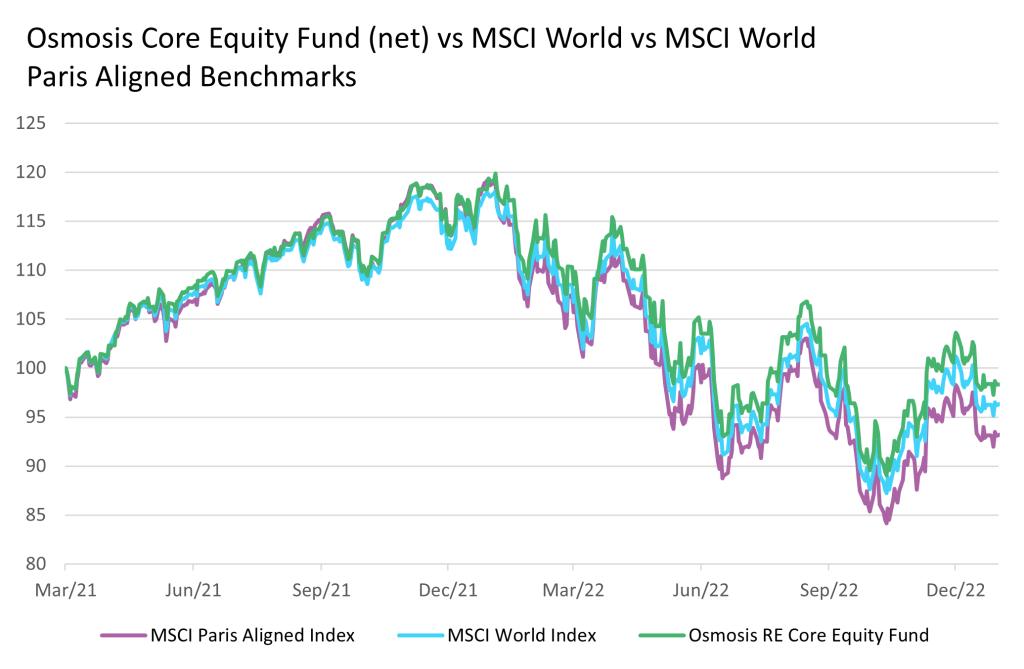

In tandem, sustainability strategies performed poorly during a period of extreme stress. Poor risk management and unintended growth exposures tended to explain the majority of such underperformance; however, as the Osmosis Core Equity solution demonstrated, sustainable behaviour was, in fact, rewarded by the market during 2022.

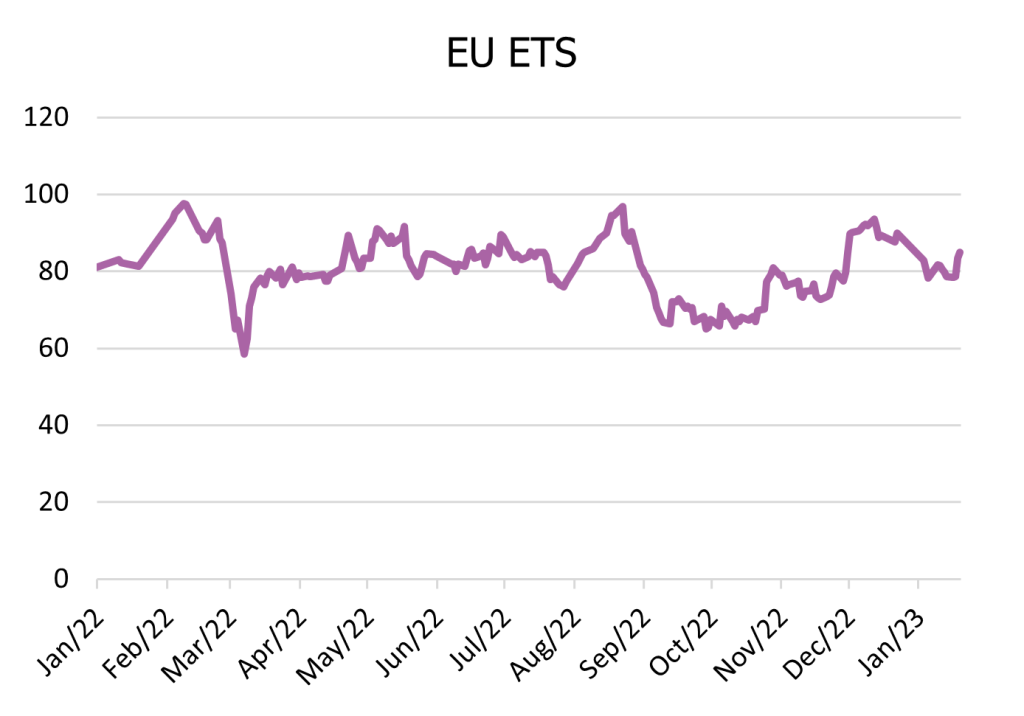

Despite the failures of COP 27, political resolve continues in some quarters. The US passed the Inflation Reduction Act (IRA) with a mammoth spending bill of $369bn. The IRA is the most significant climate legislation in US history, offering funding, programs, and incentives to accelerate the transition to a clean energy economy. Meanwhile, the EU’s Carbon Border Adjustment Mechanism (CBAM) reached an agreement between the European Parliament and Council. The price of carbon under the European Union Emissions Trading System (EU ETS) is now reaching an economically meaningful level, and the agreement to tax “abroad carbon” will add a further penalty function for resource-intensive businesses and industries that are exporting into the common market.

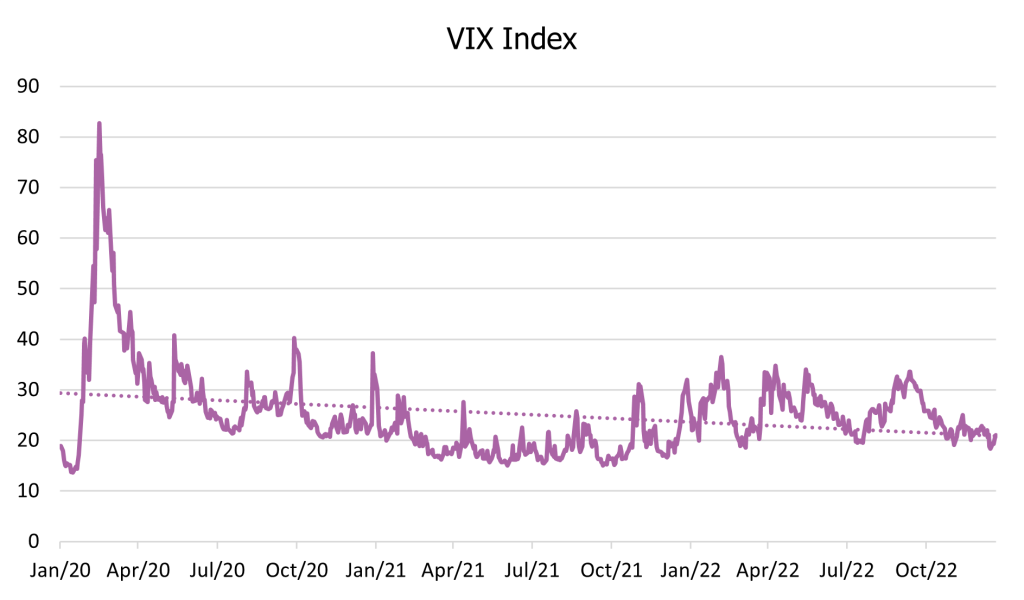

In the current environment, risk management will be more important than ever. Despite the VIX (CBOE volatility Index) reaching recent low levels, we envisage continued volatility as potential recessions (or not) start to impact the market. Given the rise in natural resource costs and the slowdown in global growth, even greater importance will be placed on resource efficient business models, and we believe sustainability will be a key criterion in managing costs in order to deliver greater shareholder value.

Past performance may not be indicative of future results. Different types of investments and/or investment strategies involve varying levels of risk, and there can be no assurance that any specific investment or investment strategy will be profitable.

IThis information may contain projections or other forward-looking statements regarding future events, targets, forecasts, or expectations, and is only current as of the date indicated. There is no assurance that such events will be achieved, and actual results may be significantly different from those noted here.