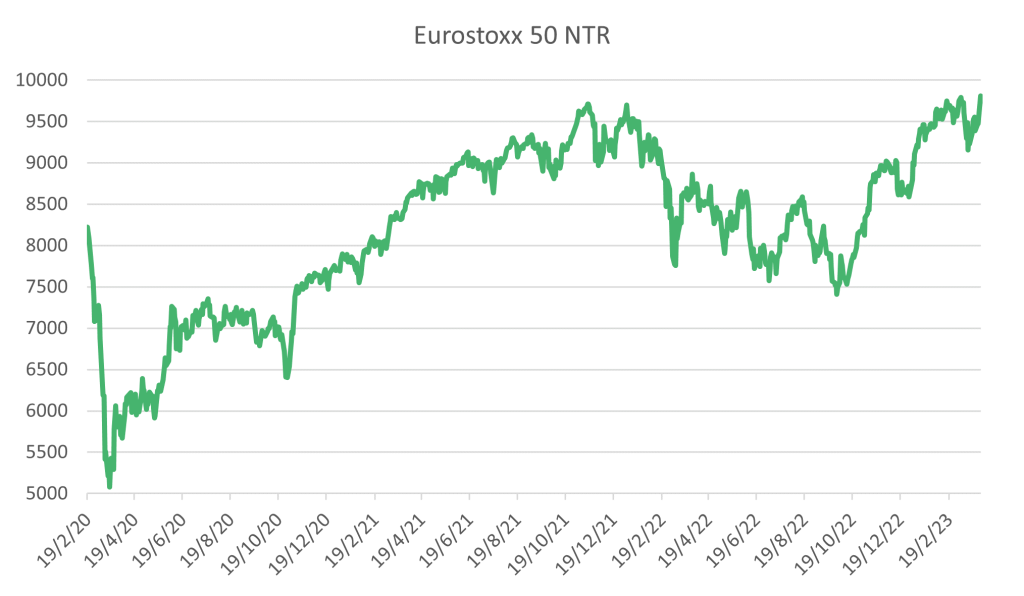

As the European bourses closed on the 19th February 2020, there was a certain infallibility to the market. Interest rates were fixed at -0.5%, the market had rallied 3.4% YTD and quantitative easing appeared to be having limited downside as general prices remained stable across the economy.

Since that point, multiple crises have begun to snowball. The covid pandemic led to a supply chain crisis. This led to an inflation crisis, compounded by the war in Europe which led to an energy crisis which in turn led to a cost-of-living crisis. To counter inflation, thanks in part to the generous supply of liquidity from Europe’s Central Bank (ECB) to dampen the impacts of Covid, interest rates have risen from -0.5% to 3%. With government debt sitting at 93% of GDP across Europe, this has placed further pressure on finite government budgets which are already under severe strain. Finally, a banking crisis has now ensued as Credit Suisse, one the largest banks on the continent has been brought to its knees and consequentially merged into UBS. Under normal market conditions, this would have resulted in a reasonable shock to the system. But what is normal these days? Whilst there was an immediate reaction, the backing of the Swiss National Bank steadied investor nerves and markets continued on their slow grind higher.

Central banks’ actions have consequences and the real economy implications seem to differ to what the equity markets have us believe. Public sector strikes are occurring almost universally across the UK as unions battle for inflation-adjusted pay rewards. France is on Fire as they protest a rise in the retirement age and in Germany, not known for its striking culture, walkouts have been called by two of the major transport unions. Despite this clustering of crises, the Eurostoxx 50 has risen 19.3% in the year to 31 March 2023, annualising 5.8%, since 19th February 2020

The elephant in the room remains the climate crisis. The Intergovernmental Panel on Climate Change (IPCC) has recently released its fourth and final installment of the sixth assessment report (AR6)*. Their press release kicked off in a positive tone, “There are multiple, feasible and effective options to reduce greenhouse gas emissions and adapt to human-caused climate change, and they are available now” However, the report remains a depressing read. What is apparent is the massive levels of investment required to avoid the worst-case scenarios. As they predict, “projected CO2 emissions from existing fossil fuel infrastructure without additional abatement would exceed the remaining carbon budget for 1.5°C”. As detailed in the report, the short-term rewards are appealing as co-benefits include greater air quality and resulting health benefits. The short-term risks are stark. “Delayed mitigation and adaptation action would lock in high-emissions infrastructure, raise risks of stranded assets and cost-escalation, reduce feasibility, and increase losses and damages.”

Europe does appear steadfast in its 1.5°C target. The carbon price is reapproaching the €100/tonne mark and importantly, the Carbon Border Adjustment Mechanism (CBAM) will be entering into a transitional phase from 1st October 2023. This is the first truly global approach to pricing in the global externality risk that is the global carbon problem. As detailed in AR6, the “vulnerable communities who have historically contributed the least to current climate change are disproportionately affected” and so alongside all the other crisis ongoing, it will be interesting to see how steadfast Europe remains in this endeavour.

Despite Europe being crisis-ridden, the Eurostoxx has proven resilient delivering positive returns since the onset of the covid pandemic. Will the urgency and scale of the climate crisis eventually break the trend? We worry that the markets are pricing the climate crisis in a comparable manner to all the other crises – close your eyes and pray. Unfortunately, though, the central bank cannot help with this one!

*https://www.ipcc.ch/report/ar6/syr/resources/spm-headline-statements/