By Drew Spangler, CFA*

The issue of climate change continues to be a polarizing topic in politics, but one thing everyone agrees on is the need for more efficiency. While president-elect Trump is clearly hostile to environmental concerns, he has committed to reducing waste by vowing to create the new Department of Government Efficiency. We agree. Efficiency is not only important for more effective government, but also the key to a more sustainable economy.

The core of the Osmosis investment philosophy is Resource Efficiency; companies using less carbon, water and waste to create more value than peers. It is not an attempt to identify climate technology leaders nor necessarily the winners in the green transition. Rather, it aims to find those companies in all sectors of the economy using sustainability to improve the existing business model. In this way, Resource Efficiency is like any other form of business efficiency, increasing profitability and decreasing risk for those companies investing in the relentless pursuit of competitive advantage.

Trump has often referred to climate policy as the “green new scam”1. He has vowed to undo Joe Biden’s signature climate legislation, withdraw from the Paris Agreement, incentivize oil and gas drilling, impose tariffs on climate technology and eliminate credits for electric vehicles (EVs). Fortunately, our investment case does not depend on the prospects for climate technology overall but rather on individual companies using sustainability as a competitive strategy. Just as pro-environment government policy is not a significant advantage for our investment process, a reversal of green support is not an obvious negative.

Resource Efficiency is inherently industry neutral. It identifies the environmental innovators in each industry but has no view on the industries themselves. To the extent that a reversal of government policy is a head wind for a given climate technology, the impact would be felt across the board for those companies. Not favoring any one industry over another, Osmosis portfolios will be impacted no more or less than the relevant benchmark.

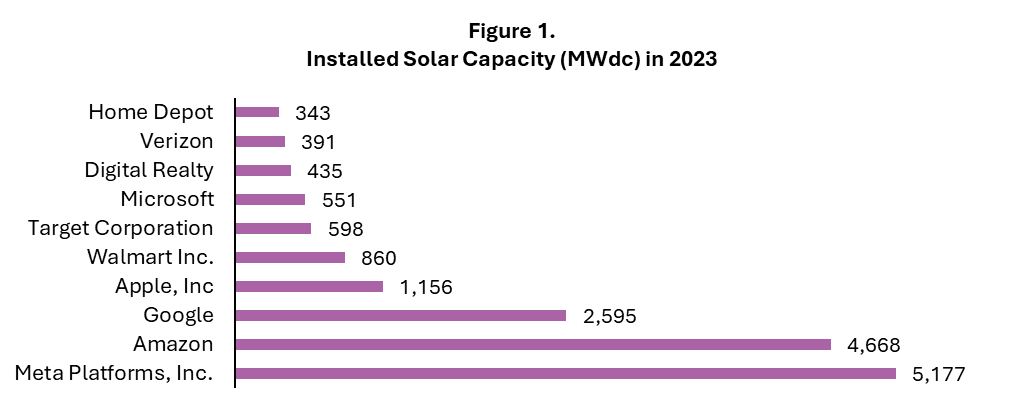

We trust that Resource Efficient companies will analyze green innovation in the same way they evaluate any other investment decision. They will assess the profit or risk reduction to be expected from introducing sustainability into their operation. As an example, many companies are investing in solar electricity production to reduce and diversify energy costs. Figure 1 lists the largest solar deployments in 2023 by company.

These companies alone represent 8% of the total installed solar capacity of the US. The size and scale of their solar deployments and the financial commitment required imply a robust business case.

We know that Resource Efficiency tends to be associated with other forms of business quality such as high profitability, low leverage and low volatility.

There are also reasons to believe that climate technology adoption has decoupled from political support. The renewable energy industry is a useful barometer. Renewables have long been the focal point of US climate policy and long-term trends in the sector increasingly suggest that economics, rather than politics, dictate the pace of development.

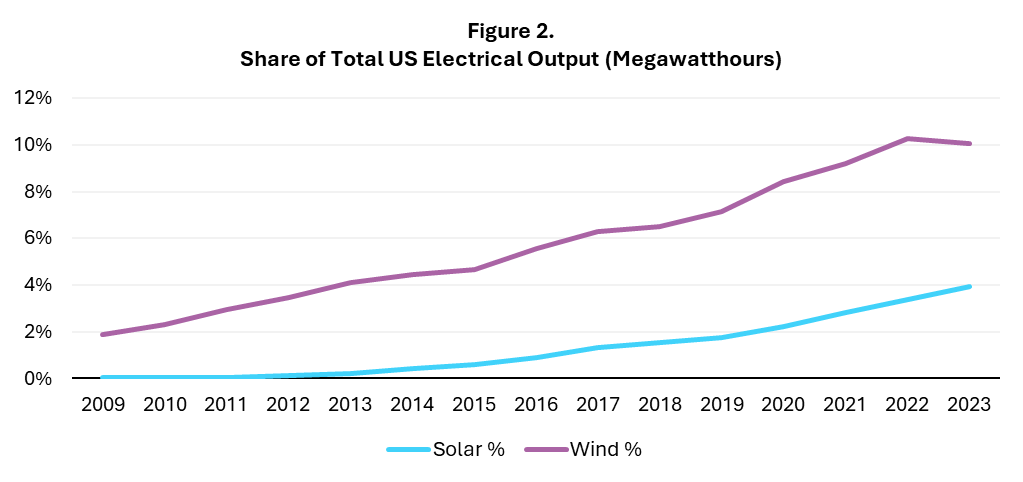

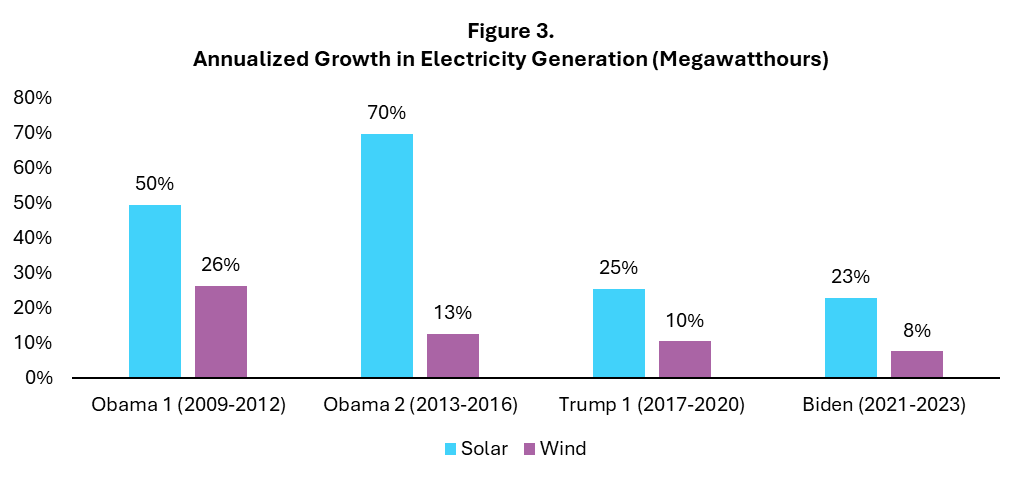

Long-term trends in renewable energy suggest that government policy may not have the impact that a simple narrative would have us believe. Figure 2 shows the growth in solar and wind as a percentage of the entire US electricity output. Even during the first Trump administration (2017-2020), these technologies enjoyed steady growth. And wind development leveled off in 2023 despite Biden’s pro-climate initiatives.

Renewable growth slowed under the first Trump administration to be sure, but the pull-back continued through the Biden years as well. The adoption of any new technology inevitably slows as the installation base increases and the high but declining growth curve in renewables is consistent with a gradually maturing industry.

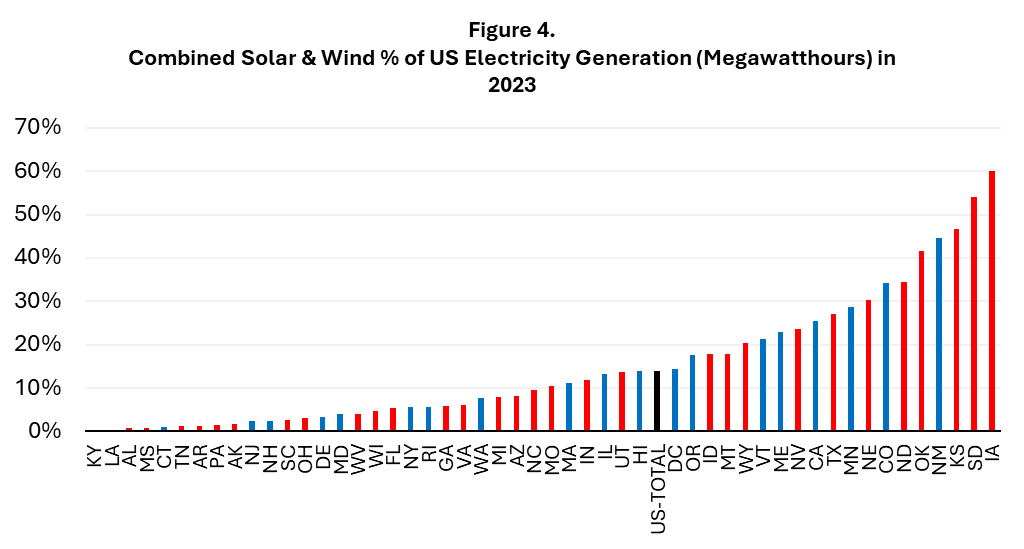

Also much of the growth in renewable energy has occurred in traditionally conservative states where climate change would be considered a polarizing issue. Figure 4 shows the percentage of the total electricity generation in 2023 that was sourced from solar and wind by state. Of the nineteen states with renewable generation higher than the national average, eleven went for Trump in 2024.

The environmental projects located in these states are popular with both politicians and the electorate. The jobs that result from green investment have been a boon to areas looking to diversify away from their traditional agrarian or industrial economies. Furthermore, the electrical sector is regulated at the state level, a historical legacy arising from the scope of infrastructure required to deliver electricity broadly and efficiently. Consequently, the authority to mandate and support renewable energy development lies primarily in state hands.

The steady growth of renewable energy through multiple presidential administrations and in states not typically known for having a green agenda suggests that the connection between government policy and climate technology adoption is not so simple. Continuing improvements in technology and manufacturing have reduced the cost of renewables to levels where they make economic sense on their own and increasingly, renewable energy and other climate technologies are being deployed where free and efficient markets determine it best.

Efficiency is better for voters, consumers, companies and the environment. It drives costs down and delivers more economic value. As the new Trump administration promises better government efficiency, the Osmosis investment philosophy will continue to focus on Resource Efficiency. We will find those companies deploying sustainability as a competitive advantage and for the most economic benefit for shareholders. It’s time that the ‘green’ in green transition refers to money as well as the environment.

1 Trump Aims a Wrecking Ball at Climate Policy, Leslie Kaufman, Bloomberg News, 11/14/2024. https://blinks.bloomberg.com/news/stories/SMY4S0T1UM0X

Important Information

None of the company examples referred to above are intended as a recommendation to buy or sell securities.

This document was prepared and issued by Osmosis Investment Research Solutions Limited (“OIRS”). OIRS is an affiliate of Osmosis Investment Management US LLC (regulated in the US by the SEC) and Osmosis Investment Management UK Limited (regulated in the UK by the FCA). OIRS and these affiliated companies are wholly owned by Osmosis (Holdings) Limited (“Osmosis”), a UK-based financial services group. Osmosis has been operating its Model of Resource Efficiency since 2011.

The information is intended only for the use of eligible and qualified clients and is not intended for retail clients. The information does not constitute an offer or solicitation for the purchase or sale of any security, commodity or other investment product or investment agreement, or any other contract, agreement, or structure whatsoever. Recipients are responsible for making your own independent appraisal of and investigations into the products referred and not rely on any information as constituting investment advice. Investments like these are not suitable for most investors as they are speculative and involve a high degree risk, including risk of loss of capital. There is no assurance that any implied or stated objectives will be met. Osmosis has based the information obtained from sources it believes to be reliable, but which have not been independently verified. Osmosis is under no obligation and gives no undertaking to keep the information up to date. No representation or warranty, express or implied, is or will be made, and no responsibility or liability is or will be accepted by Osmosis, or by any of its officers, employees, or agents, in relation to the accuracy or completeness of the information. No current or prospective client should assume that future performance will be profitable the performance of a specific client’s account may vary substantially due to variances in fees, differing client investment objectives and/or risk tolerance and market fluctuations.

*The Chartered Financial Analyst (“CFA”) designation is issued by the CFA Institute. CFA candidates must meet one of the following requirements: (1) undergraduate degree and four years of professional experience involving investment decision-making, or (2) four years qualified work experience (full time, but not necessarily investment- related). To receive the CFA designation, candidates must complete the CFA Program which is organized into three levels, each requiring 250 hours of self-study and each culminating in a six-hour exam. There are no ongoing continuing education or experience thresholds necessary to maintain the CFA designation. More information about the designation is available at https://www.cfainstitute.org.